1. Failing to Declare Your Cryptocurrencies

Whether it’s from trading, selling, or even receiving crypto as payment, you must declare your cryptocurrencies in full. Fines are €50-€1,250, and worse for repeated infractions. The SPF shall also file a tax return for you if you’re too late, which, is going to declare a much higher income than you would’ve declared yourself. So you’ll pay more for that reason too.

The SPF may also apply a tax increase of 10% to 200% on your state debt, either instead of or in addition to the state fine. Coinbase recently had to pay $21.5 million.

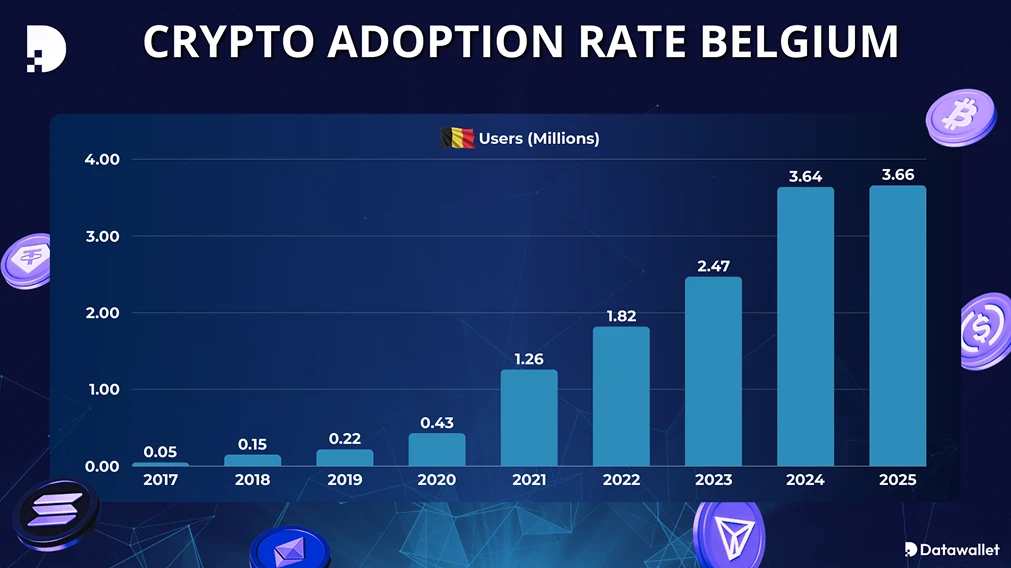

While it’s true that occasional hobbyist trading is sometimes treated differently, the Belgian tax authorities have a crystal clear view of what you’re doing, especially considering the DAC8, which requires platforms to inform EU authorities of investors’ holdings upon request. A lot of that is automatic. It has to be observed by every exchange and app by December 31, 2025.

2. Crypto Tax Mixup: the Personal & Professional

Occasional transactions for personal use is generally treated as private gains subject to cryptocurrency profit tax. These gains may be taxed at a lower rate or, in some cases, even be tax-exempt if considered irregular and speculative. It’s when you conduct such affairs on a particularly structured basis that’ll get you considered as a business, which it won’t matter even if you’re a freelancer or a huge organization. If it’s clear that this is one of your main ways you make money or you use high tech to conduct your pursuit of crypto, you pay income tax mostly.

3. Ignoring Small Transactions in Crypto Taxes

When you declare your cryptocurrencies, you may make the mistake of overlooking small trades or minor crypto transactions, assuming they aren’t worth reporting. It may seem harmless, but even small transactions can add up over time, and the Belgian tax authorities consider the cumulative gains when calculating taxable income.

For example, selling €50 worth of Bitcoin once a week may not feel like a big deal, but over a year, these small sales can accumulate to several thousand euros. Failing to report them could have you ending up swarmed in audits or penalties. Also, virtual cash trades, like swapping Bitcoin for Ethereum, are often considered taxable events, even if no euros change hands if you make gains.

4. Failing to Document: Buy Crypto Tax

One of the easiest mistakes to make is buy crypto tax going unrecorded, but also one of the most costly.. Even if you’re dead honest with them, the Belgian tax authorities will request proof in the event of an audit. And the burden of proof is completely on you.

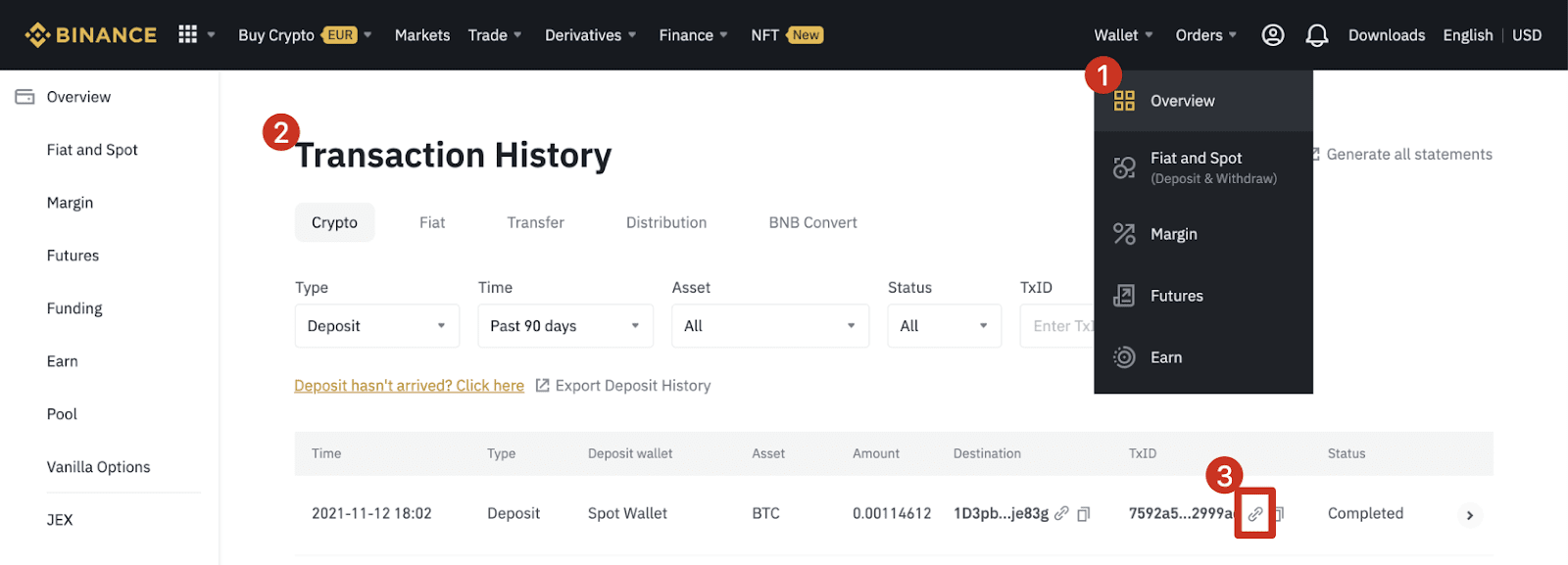

That means you need to:

- Keep a centralized software or spreadsheet.

- Export monthly or quarterly transaction histories.

- Save screenshots or PDF confirmations of trades, staking rewards, or crowdlending interest payments.

- Keep longtime records.

5. Overlooking Coinhouse and Crypto.com Tax Declaration

Another mistake Belgian crypto investors often make is ignoring virtual cash trades and wallet transfers for Crypto.com and Coinhouse tax declaration and other platforms. Many believe that moving assets between wallets or swapping one cryptocurrency for another doesn’t count as a taxable event. Indeed, there’s no tax if both of the wallets involved belong to you, but regardless of the asset, if you made a gain, that needs to be reported starting in 2026.

In the past, prudent investors didn’t have to file, but now they do, since there will be a 10% solidarity tax for long-term investors as well for gains made on January 1, 2026, or later. Use crypto portfolio and taxes trackers.

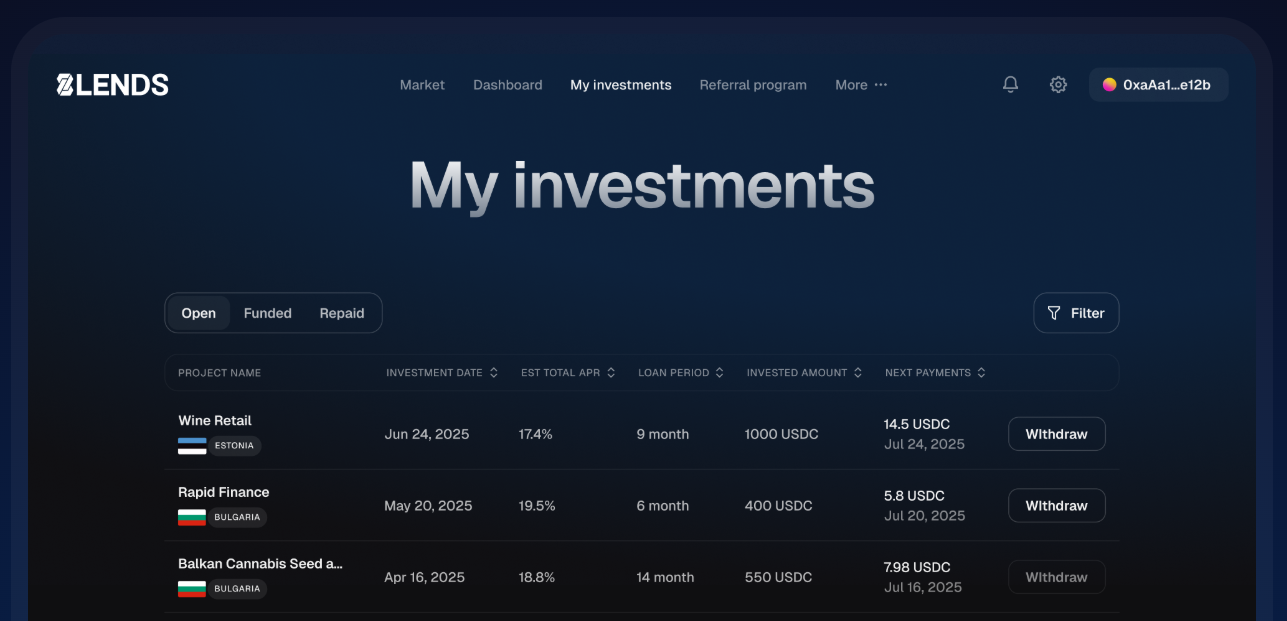

Transparent Diversification

If tracking staking, DeFi income, or multiple wallet transfers feels overwhelming, consider diversifying with crowdlending through 8lends. The platform allows you to lend crypto to verified borrowers and earn predictable returns without the complexity of staking or DeFi protocols.

- Simpler reporting: detailed transaction records.

- Predictable, collateral-backed income: Unlike variable staking or liquidity pool yields, crowdlending returns are easier to forecast.

- Portfolio diversification: another way to earn from crypto without constant trading.

6. Misunderstanding What Country to Declare Your Cryptocurrencies In

Crypto tax government obligations depend heavily on residence. Filing incorrectly can lead to double taxation or penalties for underreporting. Living abroad does not necessarily exempt you. Even having spent 7 days there you could still end up a resident.

Unlike many nations, Belgium doesn’t consider 183-day stays.

- Your main home: where you live, whether it’s owned or rented

- Where your spouse and children live

- Where you work or run your business

- Where you bank and conduct your most important economic ties

7. Relying on Exchange Summaries Only

A common shortcut many Belgian crypto investors take is depending solely on exchange-generated summaries when filing taxes. These summaries can be helpful, but they often don’t capture every taxable event and may omit important details needed for accurate reporting.

For instance:

- Some exchanges don’t include crypto-to-crypto trades, staking rewards, or DeFi transactions in their summaries.

- Transfers between wallets or platforms may not be reflected.

- Differences in valuation timing can create discrepancies if the exchange reports using its own timestamp or conversion method.

8. Declare Your Cryptocurrencies Correctly by July 15th

Everyone is busy in the crypto and taxes world, as a lot of close watching is required of a myriad of different potential assets to invest in. This is especially true if you hold responsibility as a staker or mine for crypto all the time or run a company full of employees. Remember that the deadline to file your return on Tax-on Web is July 15th (or June 30th, if for some reason you prefer filing a paper return). If you do plan on filing late, be sure to apply for it before the former date. Of course, you still get to file by October 28th as well if you decide to do so using a tax professional.

Be sure to convert all your assets’ value into euros correctly while keeping correct track of the dates you performed each and every transaction. Some people forget to jot down the dates.

9. Not Considering Gifts, Donations, and Airdrops

Since they don’t make any profit off of these themselves, many Belgian investors forget about these in cryptocurrency tax declarations. While you might think transferring crypto to a family member or friend is harmless, the Belgian tax authorities treat these actions differently from regular trades.

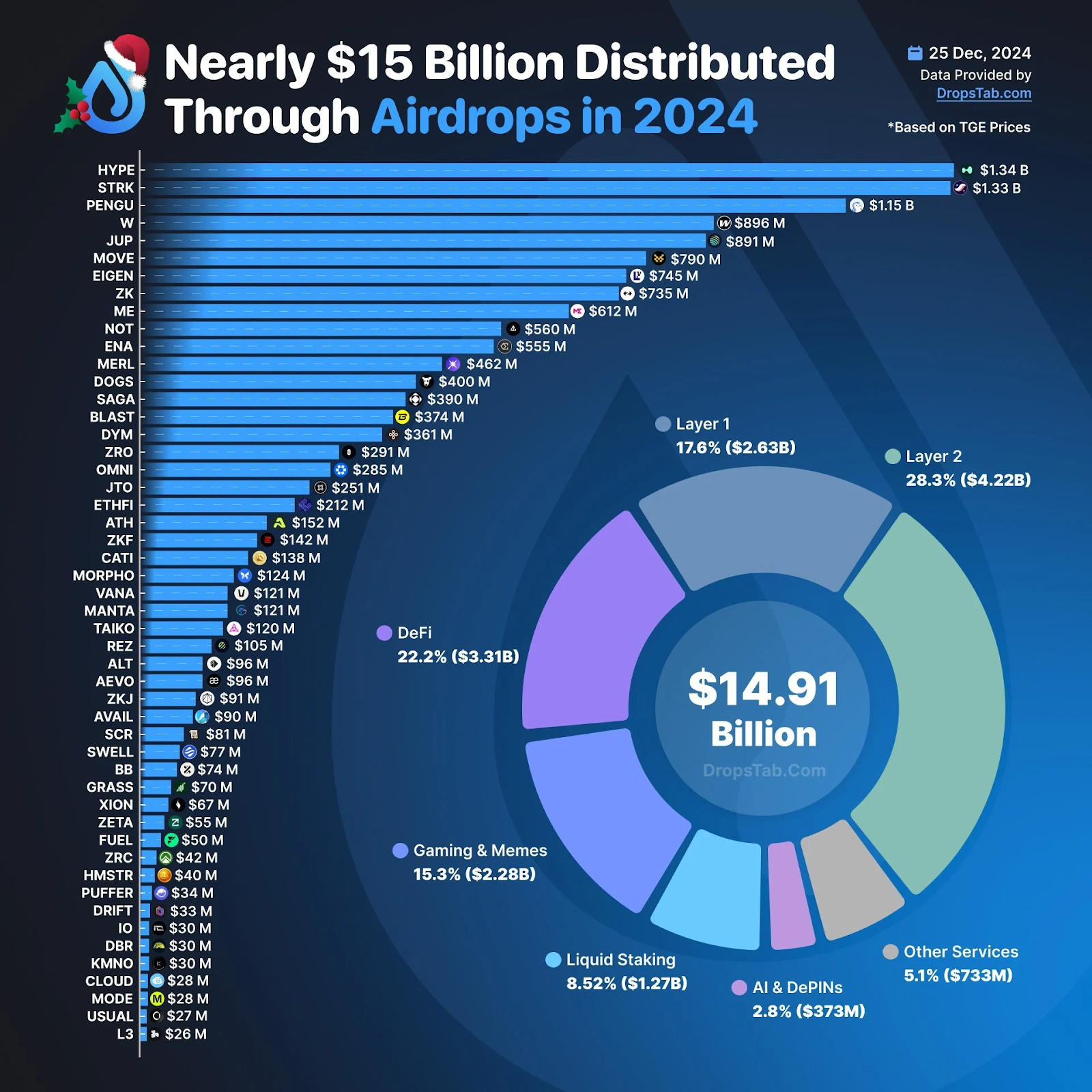

Transferring crypto to someone else entails a gift tax calculated as the cost of the gift when gifted minus its value when you initially acquired it. Donations, even to charitable organizations, are to be reported and some will give you credit on your taxes. There is no official position on airdrops, but one court ruling declared that all such events are to be taxed at 33%

10. Failing to Seek Professional Advice

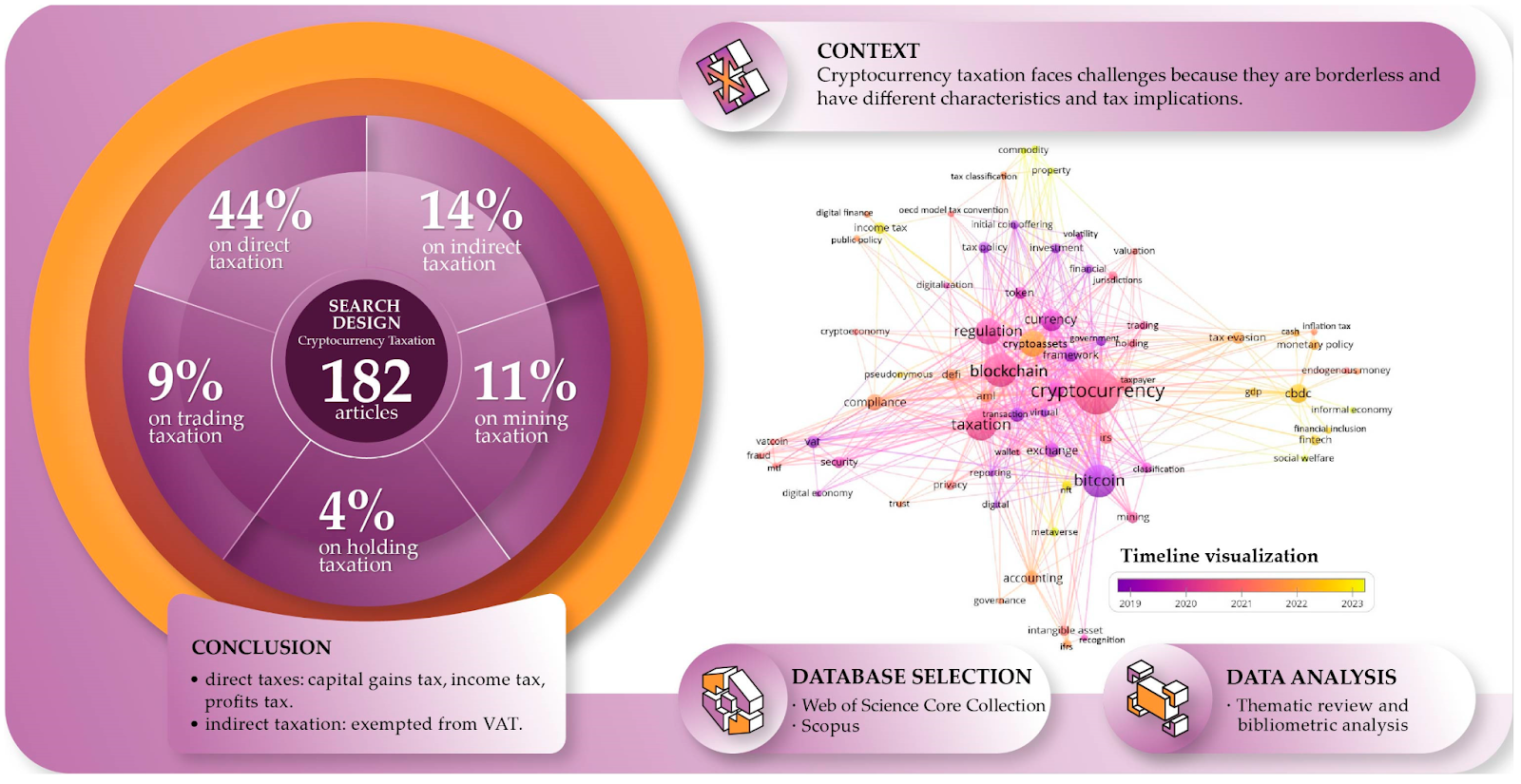

Finally, many investors try to navigate complex tax rules without professional guidance. Cryptocurrency taxation is still a rapidly evolving area, and even little errors can have you in for a terrible overpayment as well as remaining unaware of wonderful ways you can deduct what you owe. In the vast majority of cases, you will profit greatly from gaining that valuable knowledge from a company who narrowly focuses on Belgian taxes.

Final Thoughts

Crypto taxation in Belgium can be confusing, but being aware of these 10 common mistakes can save you from fines, penalties, and unnecessary stress. From failing to report income, confusing personal and professional trading, ignoring small transactions, and neglecting documentation, to misinterpreting tax residency or missing filing deadlines, each error costs a lot more than the time investment to become aware of it.

The key to staying compliant is meticulous record-keeping, arming yourself with handy tools, and understanding your tax obligations. Tools like crypto trackers, tax software, and platforms such as 8lends can simplify reporting and help you manage your crypto income efficiently. In the process, 8lends helps you add lucrative interest projects to your portfolio in loans whose risk you share with numerous other investors. If they ever default, your returns are always guaranteed by collateral.