Key Crypto Declaration Dates and Rules

One doesn’t just file the crypto declaration whenever. March 1 is day one. The Dutch tax portal Mijn Belastingdienst opens accepting people’s Aangifte Inkomstenbelasting for the year prior and everything is counted as it stood on January 1. You pay for the entire previous calendar year’s taxes, if you owe.

May 1st is the standard filing deadline if you want to avoid being penalized and having the tax office estimate your numbers for you, which may not be as generous as what you would’ve given yourself.

Have documents on:

- your wallet balances

- exchange balances

- transaction history

- staking/lending/mining reports

- debt documentation

If you do owe taxes and it’s more than you can stomach right now, you can file your taxes early so you can get an early assessment.

Residents who haven’t paid taxes on July 1 start getting charged interest.

How Tax on Crypto Works in the Netherlands

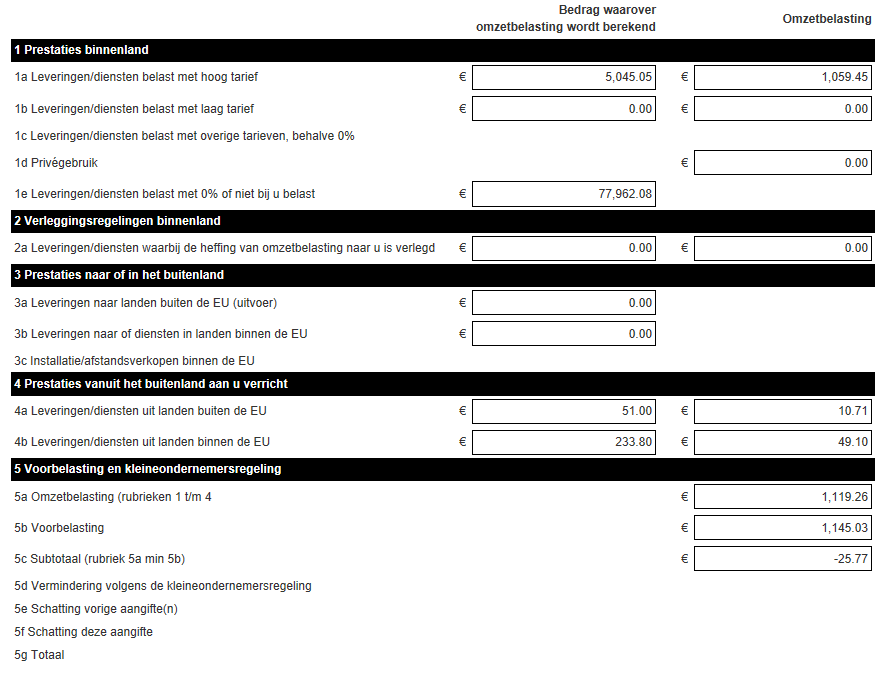

The crypto declaration form has two boxes on your income, fillable with information relevant to crypto. In Box 1 goes business’ crypto income or if you work solo but you spend significant time engaged in blockchain-type industries, since these are deemed full-fledged business ventures and thus, it’s regarded like other profit pursuit ventures.

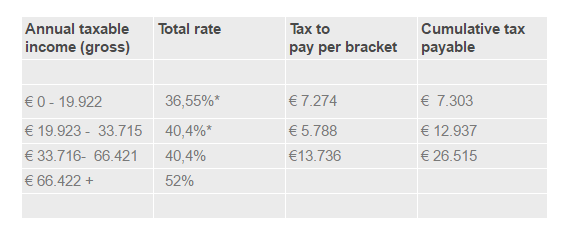

Income tax brackets:

- 0-38,441 euros: 35.82%

- 38,441-76,817 euros: 37.48%

- 76,817 euros +: 49.50%

Box 3 has asset holdings and a myriad of different coins that casual investors can earn or buy. This includes staking, crypto coin holdings, and liquidity pools. Exchanging crypto for fiat currency is non-taxable in the Netherlands, in contrast with the majority of countries. Staking and lending also go in Box 3, which will save investors a lot of money.

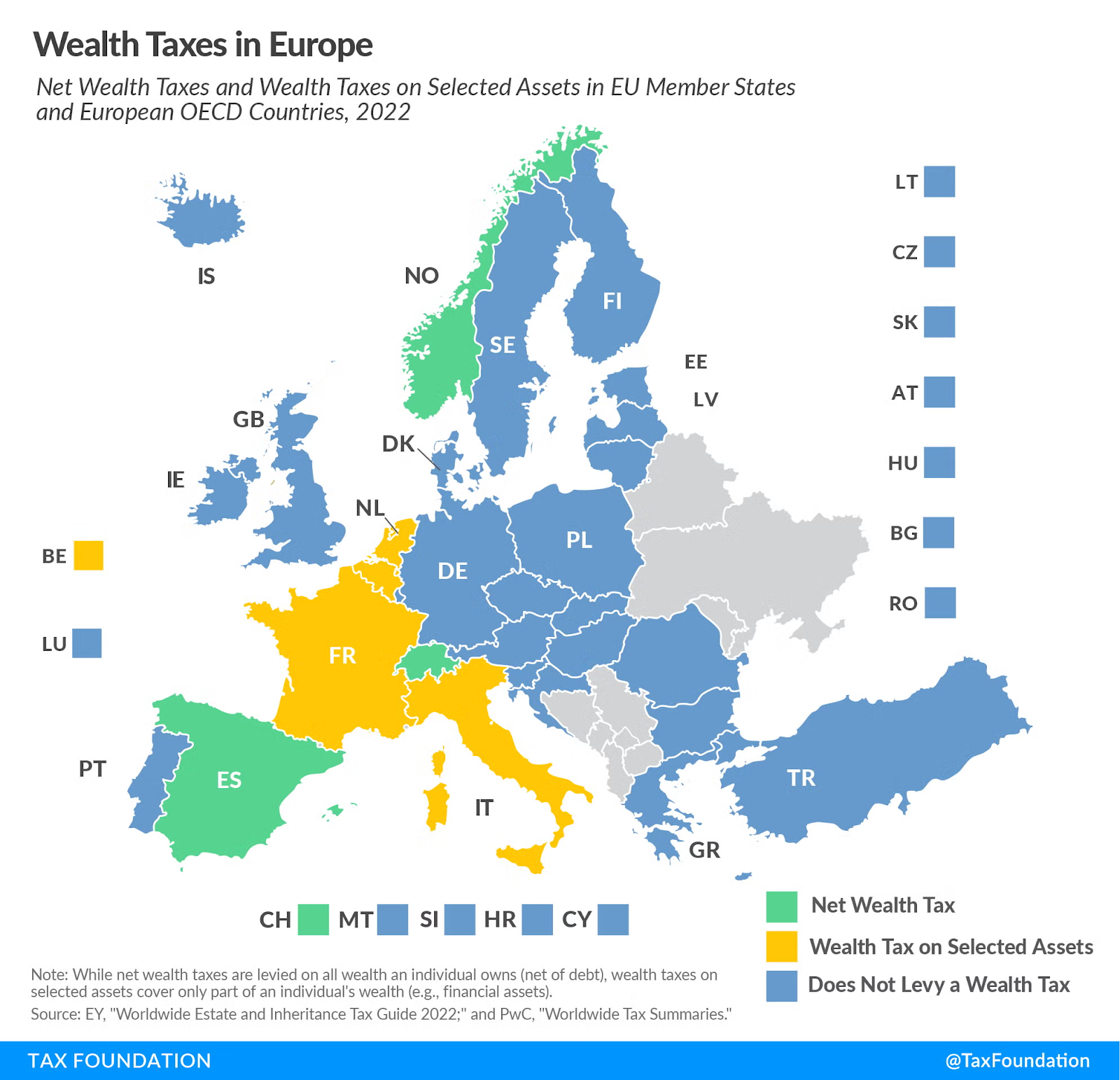

Wealth Tax

Aside from ordinary work income and business, the cryptocoins you hold, along with stocks, dividends, rent money, and any other gains you make off of assets are calculated simply based on how much value in assets you own as of January 1st compared to the same date of the previous year. There is a standard deduction of 57,000 euros as well, even if you traded virtual cash like mad.

The government then applies a coefficient to calculate a fictitious presumed total that you likely gained over that year period – 0.92% on your savings, and 6.17% in your investments, which include crypto, minus your deductible debt times 2.46%. Since such a policy was stricken down by the Supreme Court as unconstitutional 4 years ago, you now have the option to opt for that fictitious total, or calculate your actual gains or losses over the past year, accompanied by robust documentation.

Non-Taxable Events

With a net worth under the threshold or handling NFTs you pay zilch, unless the tax office sees numerous business machinations for a profit. No statement’s been issued on airdrops. If audited, the state may say to enter that under Box 3, but for art’s sake, you can collect without owing.

Gifts also are not taxed, provided that they remain under 3,244 euros in value, or in family cases – 6,604. If you give to charity, once such a donation will go untaxed and may also give you credits on your taxes, but it must be 1-10% of your net worth.

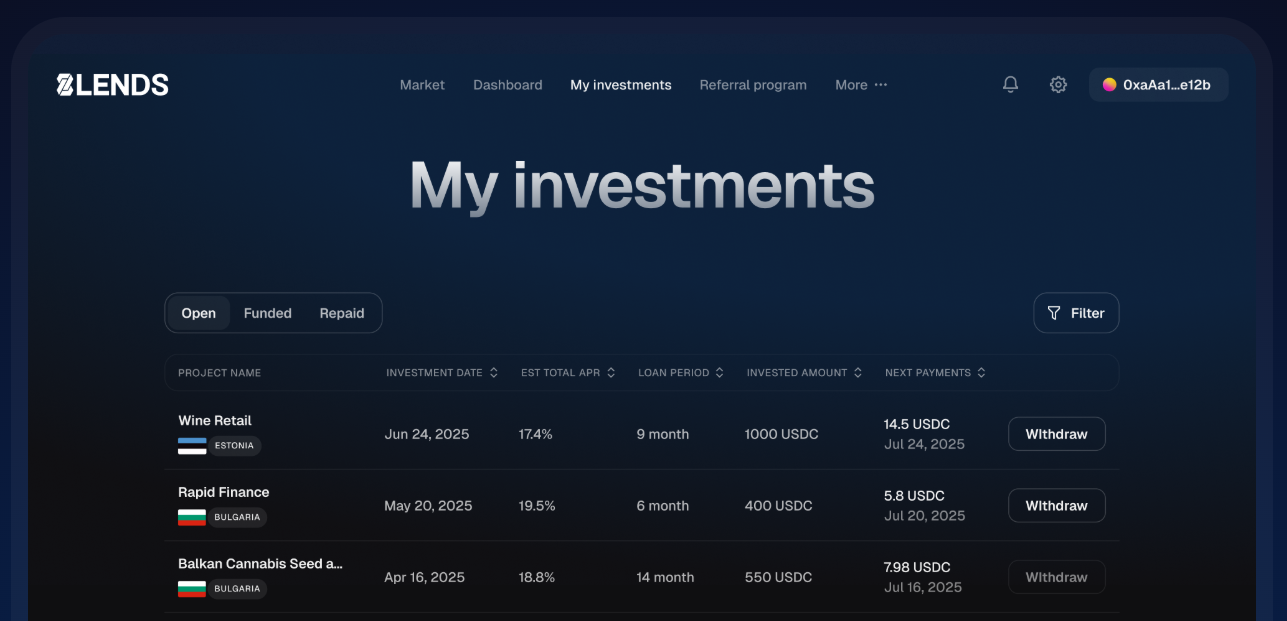

Crowdlending

If you want to put your crypto and savings to work beyond just holding them, consider 8lends crowdlending platform. It lets you invest in collateral-backed loans with lucrative interest rates, giving you the opportunity to earn passive income while keeping risk managed. Beyond personal gain, your investments help meaningful communities and projects that have no access to traditional financing, making a real-world impact.

Whether you’re new to investing or an experienced investor, 8lends provides a streamlined platform to diversify your portfolio and support projects that otherwise wouldn’t get off the ground.

Tax and Crypto: If You Miss the May 1 Deadline

Mounting pressure shall be applied should you fail to pay crypto profit tax on time. If an extension’s requested in advance, you could escape it unscathed. Otherwise, you’ll pay up to 150% if you did so in good faith, if deliberately – as high as 300%.

That also depends on your history. They’re going to keep giving you reminders, and if you ignore them, chances are the Belastingdienst will issue a default assessment for you, assuming figures on their own. So you could end up with a disastrously unfavorable tax bill. Then, on July 1st, you start owing more and more interest on whatever portion has remained unpaid.

Of course, that also makes it much more likely you get audited, and they have a sharper eye on crypto investors as it is. They may end up discovering unreported wallets and operations that way. Sure, you’re not likely to encounter severe consequences just for failing to file once, but it will snowball on you.

The standard penalty starts at around 385 euros for individuals and can go well over 5,000 euros if you repeat the offense. The interest rate typically hovers around 4-8%. That’s why it’s a wise move to consider early filing.

If Your’re Late Paying Tax on Crypto

The Belastingdienst does provide ways to correct the situation and afford you more forgiving penalties. If you act quickly, it’ll go a long way. You can simply ask them to work with you while explaining your situation. They may even reduce or cancel your late filing penalties. Being transparent will garner understanding. If you happen to notice that you made some mistakes in your return after filing, let them know as soon as possible, and include detailed backup for valuations and your activities.

Documentation for Paying Tax on Crypto

You absolutely must collect records for everything if you plan to go with actual gains and losses as your method for paying crypto profit tax. Also keep in mind that your losses can offset your gains, and if you had a down year or didn’t gain 57,000 euros in wealth, you owe nothing for it, aside from your ordinary job or business. So you’re going to need to download transaction histories from every platform and jot down your virtual tokens that you hold on them, both a year ago and this past January 1st.

Don’t forget:

- hardware wallets and software wallets

- custodial accounts

- the euro value of each coin at the beginning of both years

- the dates for each transaction you completed

- internal transfer histories between your wallets

- Staking, lending, and DeFi records

- Debt documentation: student loans and mortgages count

Final Thoughts

Navigating crypto taxes in the Netherlands does not have to be stressful Even if you miss the May 1 deadline you can still get back on track by responding quickly keeping detailed records of your wallets exchanges staking lending and debts and understanding how Box 3 wealth tax works Whether you use the fictitious return method or report your real gains the key is being organized and proactive so you avoid penalties and extra interest

While reviewing your finances it also makes sense to think about how to grow your assets instead of letting them sit idle That is where 8lends comes in It is a Swiss crowdlending platform that lets you invest in collateral backed loans with lucrative interest rates while helping meaningful communities and projects that do not have access to traditional financing It allows you to diversify your portfolio earn passive income and support real world initiatives that may never get funded otherwise