What Social Proof Means and Why It Matters

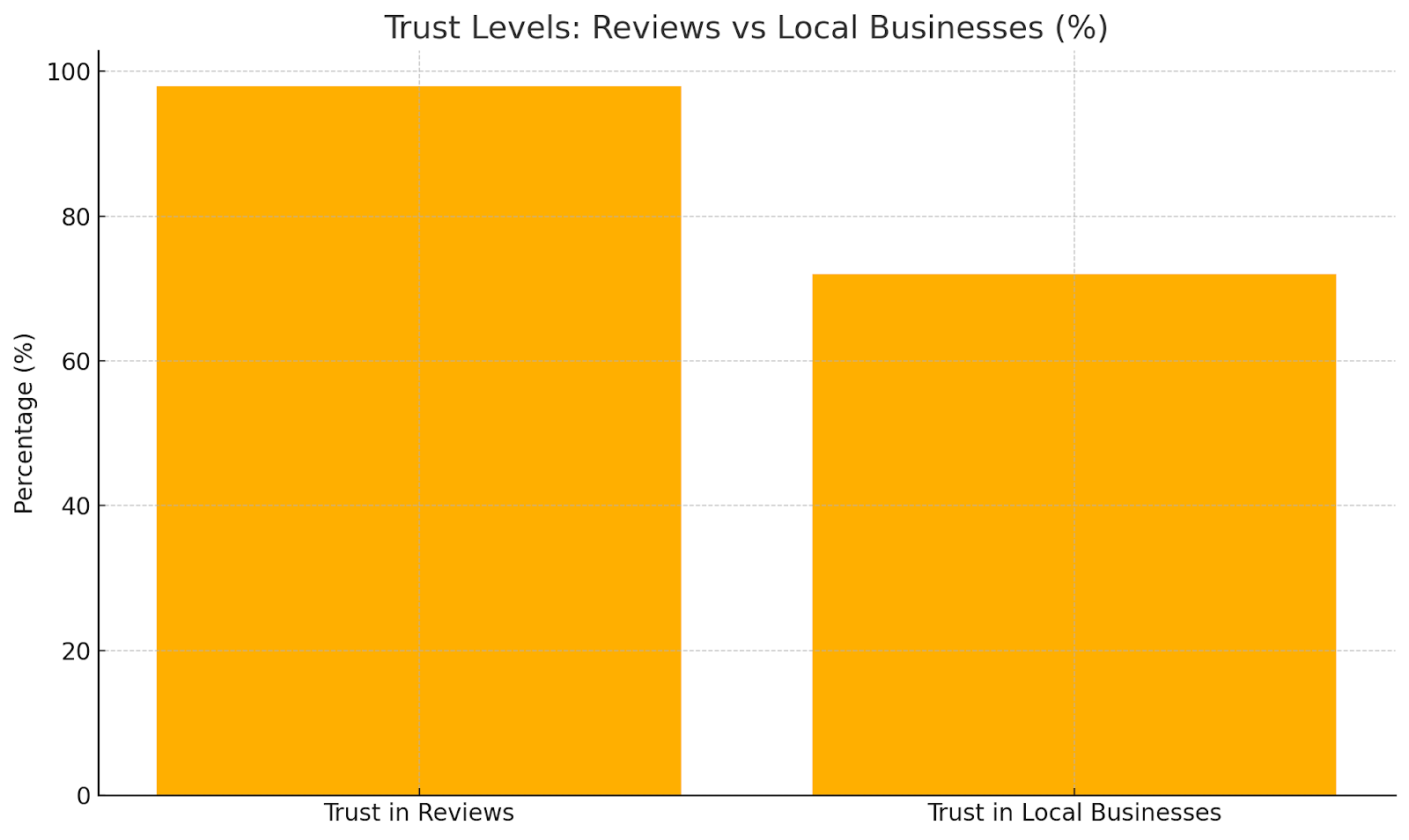

Social proof concerns the ways people copy others when they aren’t sure what to do. Robert Cialdini first coined it. People watch their peers so that they feel safer and cut down on worry. In lending, this shows up as online reviews, online media endorsements, and connections in your network. A study on consumer behavior found that 98% of shoppers see reviews as a key tool and 72% trust local businesses more if those reviews are good.

That same trust helps lenders sort out how likely a borrower is to pay back a loan. Social proof in lending can include:

- Community Reviews: Such feedback often comes in the form of ratings and testimonials. Lenders read these peer reviews to get a sense of how trustworthy a borrower is.

- Online Media Presence: A borrower’s activity on networks such as LinkedIn or X can show how stable they are or how solid their professional reputation is. This kind of presence helps shape a lender’s view of them.

- Endorsements and Relationship Ties: In P2P lending, endorsements from friends, family, or fellow group members serve as proof. When someone close vouches for a borrower, others feel more confident in funding that loan.

Under the surface are a few simple psychological forces driving all of this. Public validation and the bandwagon effect nudge people to follow what others are doing. Conformity plays its part too. Seeing many peers back a loan makes a lender more likely to join in, to align with what seems to be the right choice.

Reputational Image in Peer-to-Peer Lending: How It Works and What We See

Some peer-to-peer lending sites let people borrow money straight from others. This setup cuts out banks and their heavy focus on credit scores. Instead, platforms like 8lends use community feedback and borrower stories to give lenders a clearer picture. Some details come from past borrower ratings, while others come from friends or online groups backing a project. Together, these historical clues help fill in the blanks about who will pay back their loan.

Public Connections and Endorsements

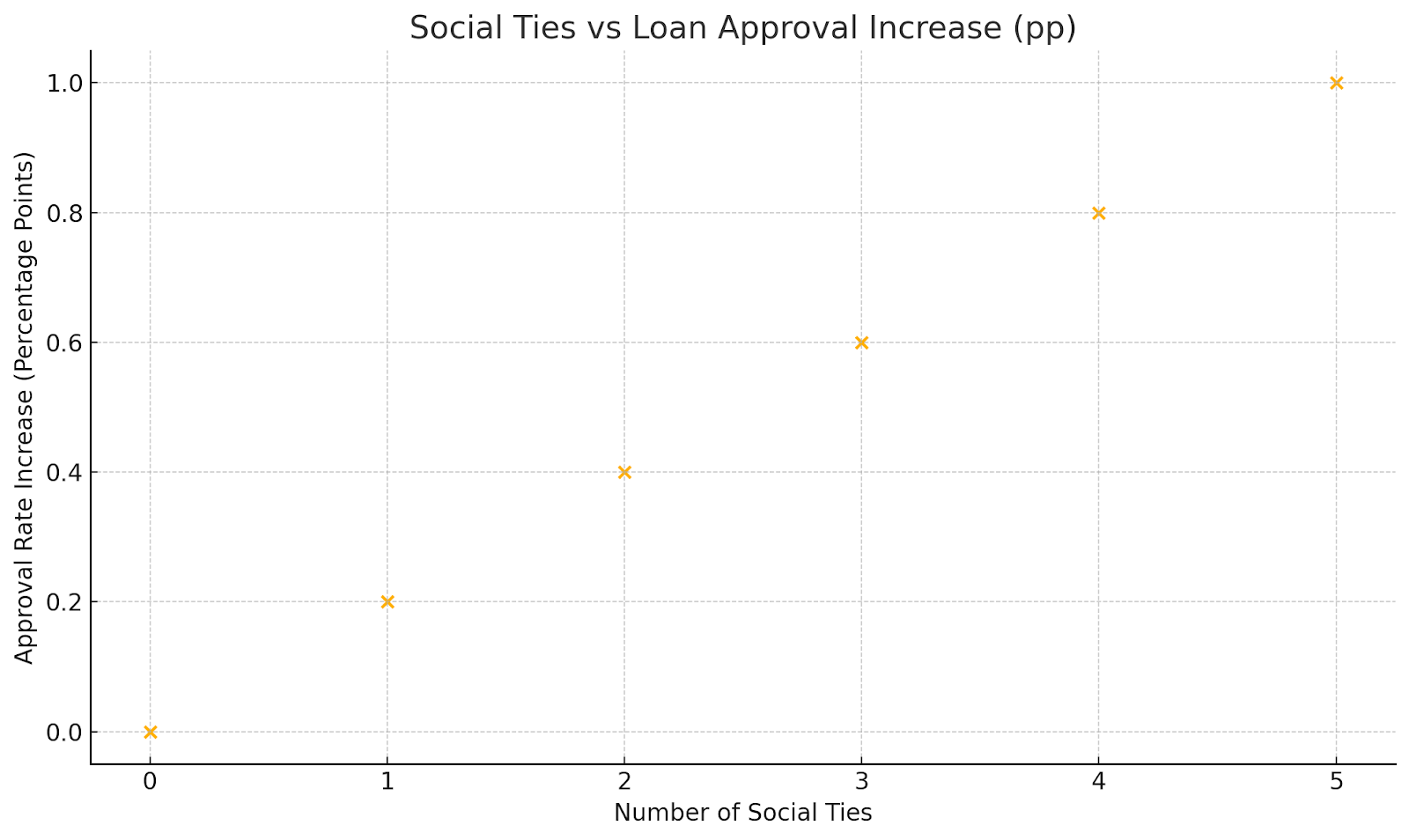

Freedman and Jin researched that people with social links are 0.2 percentage points more likely to secure a loan and get a 0.4 percentage point lower interest rate. Lenders use those links as a sign that a borrower is more reliable.

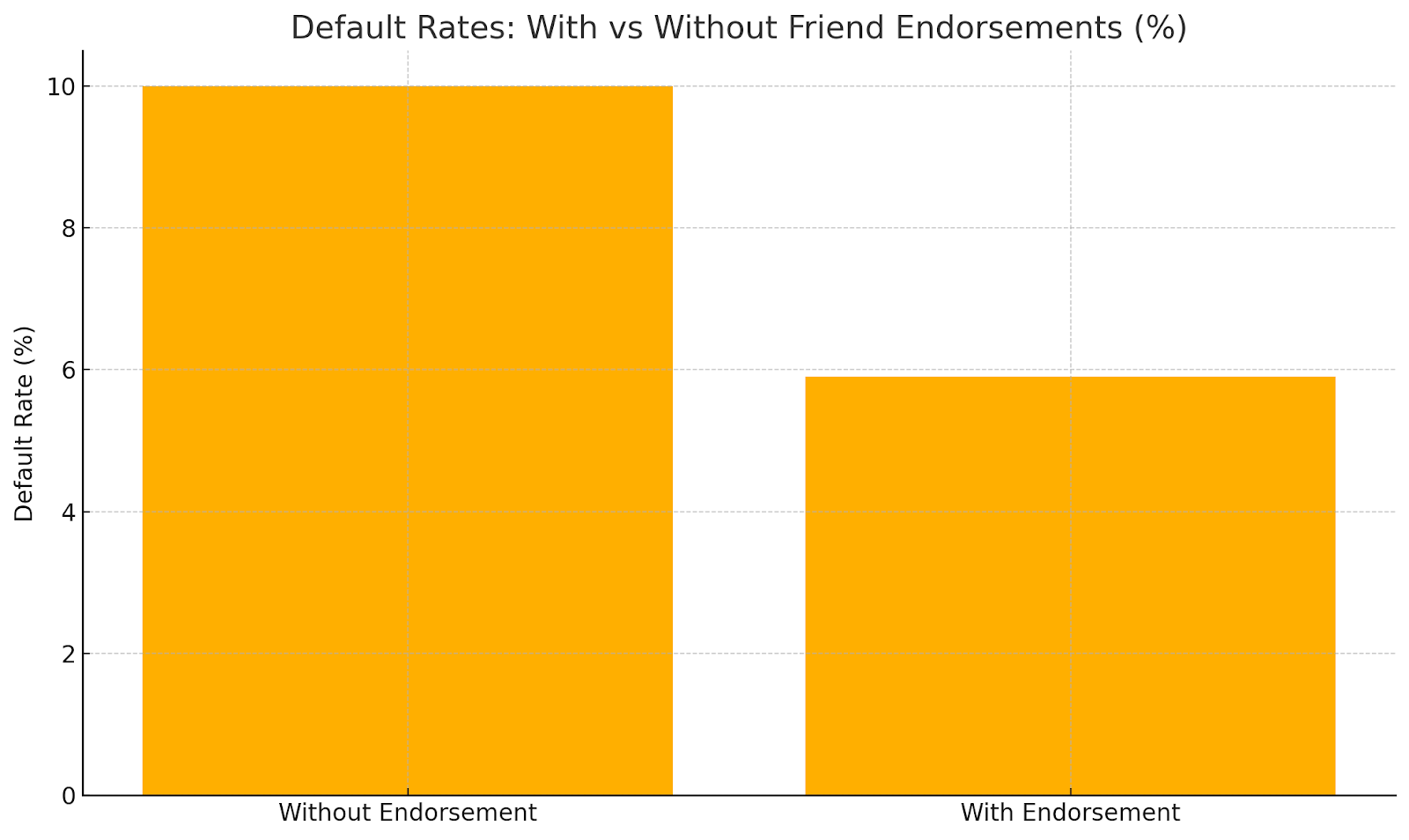

There is, however, a key downside. Borrowers with social ties often pay late or even default more than others. It turns out social proof doesn’t always match true credit risk. One standout exception involves endorsements from friends who also chip in money. Those loans showed a 4.1 percentage point lower chance of default and a 6.0 percentage point higher return.

Learning from Community Feedback

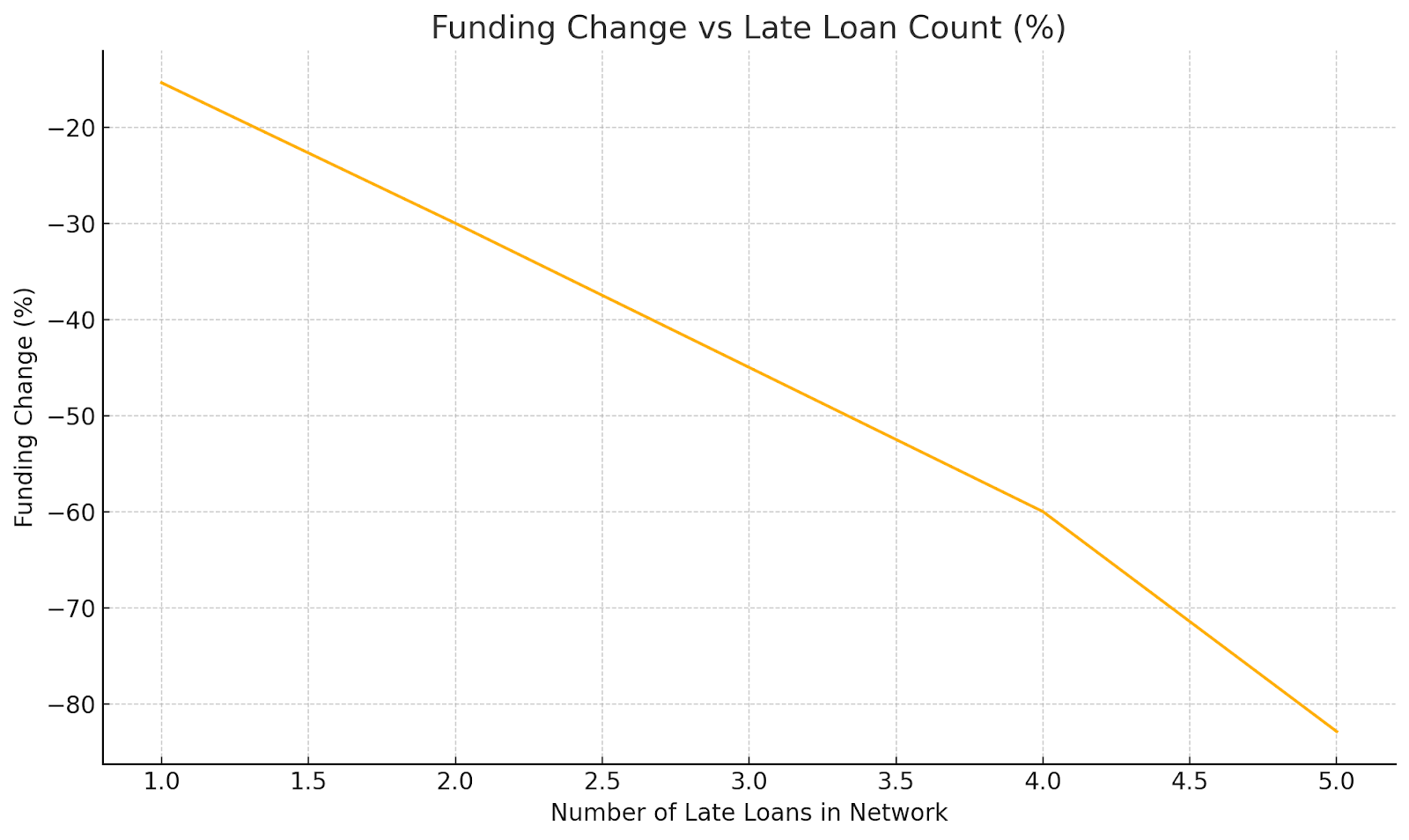

Lenders on P2P platforms look at community feedback, like the repayment history of loans in their social networks, to guide what they do next. A study by NBER found that when earlier social loans are late, lenders cut funding by 0.050 to 0.070 and change investment amounts by 15.382 – to 82.880.

They learn from these experiences. Community performance then acts as proof from the group to shape lending choices over time.

The Role of Community Reviews in Lending

Community reviews play a big role in peer-to-peer lending. Borrowers earn ratings from lenders, and lenders share feedback on each other to build a picture of reliability, for instance based on things like their percentage of late payments. Those numbers guide funding choices. In fact, an NBER study shows that every 1 percent rise in late payments cuts the chance of funding by 0.182 (p < 0.01). That finding makes it clear how much weight community feedback carries.

In traditional lending, community reviews have less obvious sway, but their influence is growing. Lenders might check a borrower’s LinkedIn profile or look at their activity on X as extra proof of trustworthiness. Credit scores serve a similar purpose. They act as pooled relationship proof, reflecting the verdict of previous lenders based on past repayment behavior.

Digital platforms boost the power of community opinions even further. Trustpilot’s research found that 82 percent of people say positive star ratings and reviews sway their decisions. This survey of 1,697 consumers across the U.S., UK, Australia, and Europe shows how peer validation matters in finance transactions. It underlines that seeing others’ approval makes a difference.

Benefits of reputation boosts and community reviews

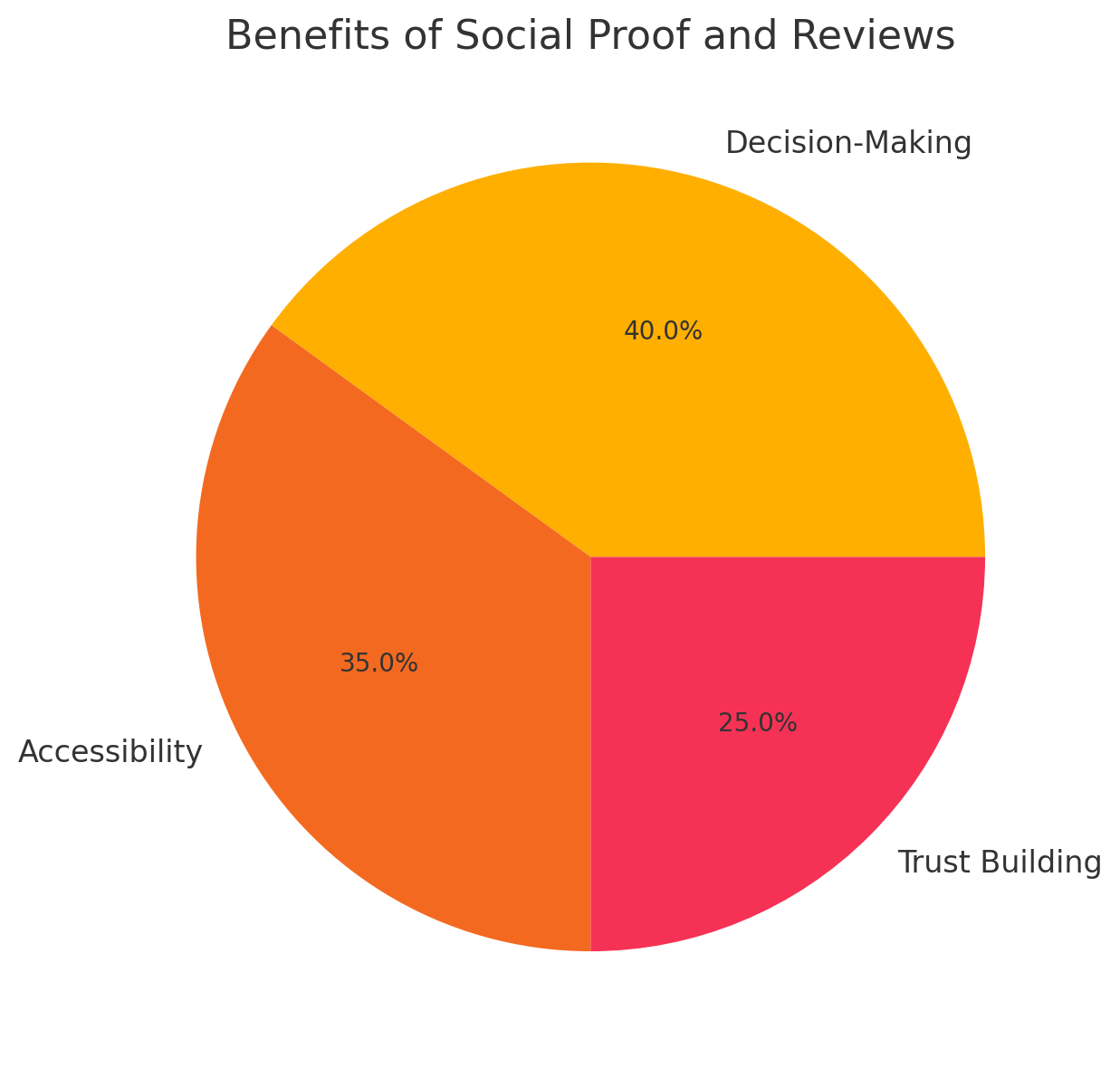

The use of public endorsements and community reviews in lending has its benefits, which include:

- Enhanced Decision-Making: Public endorsements add extra clues for lenders. They see social ties or reviews alongside credit scores and histories. This matters a lot in peer-to-peer lending, where real information can be hard to find.

- Increased Accessibility: Some platforms tap social proof to link lenders with people who usually lack access to loans. This approach helps more people join the financial system without big banks.

- Trust Building: Good reviews and endorsements help people feel safe using a lending site. More trust leads to more users and more loans being made.

Risks and Challenges of social proof and community reviews

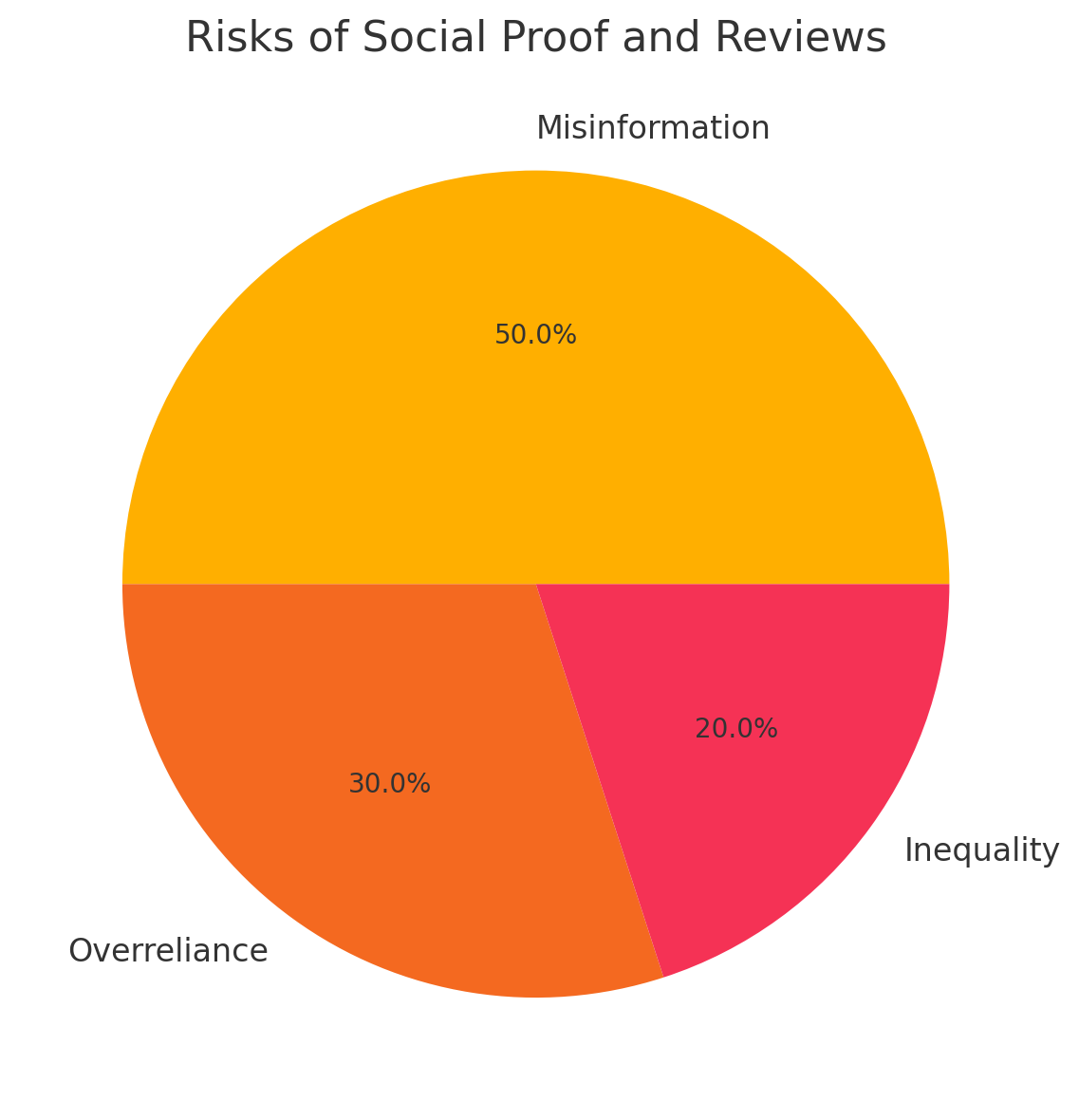

No system is perfect and will come with its challenges and risks. For social and community reviews, they include:

Misinformation

People can fake social proof. Some borrowers might boost their profiles with false endorsements or exaggerated networks. This can mislead lenders into thinking someone is more reliable than they really are.

Overreliance on Social Signals

Lenders sometimes put too much weight on social proof. Close social ties usually cause higher default rates. If proof isn’t checked, it can cause bad loan choices.

Inequality

Those with bigger or stronger networks gain an edge, which can widen financial gaps. This raises moral questions, especially under rules like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), which limit how social data is used in lending.

Regulatory and Ethical Considerations

Social proof is showing up more and more in lending, and rule makers are paying attention. Platforms need to be clear about how they use social proof so that no one is treated unfairly because of their circle of friends or followers. They must follow privacy rules when they tap into social media data, giving lenders the insights they need while still protecting each person’s rights and keeping their information safe.

Future Trends

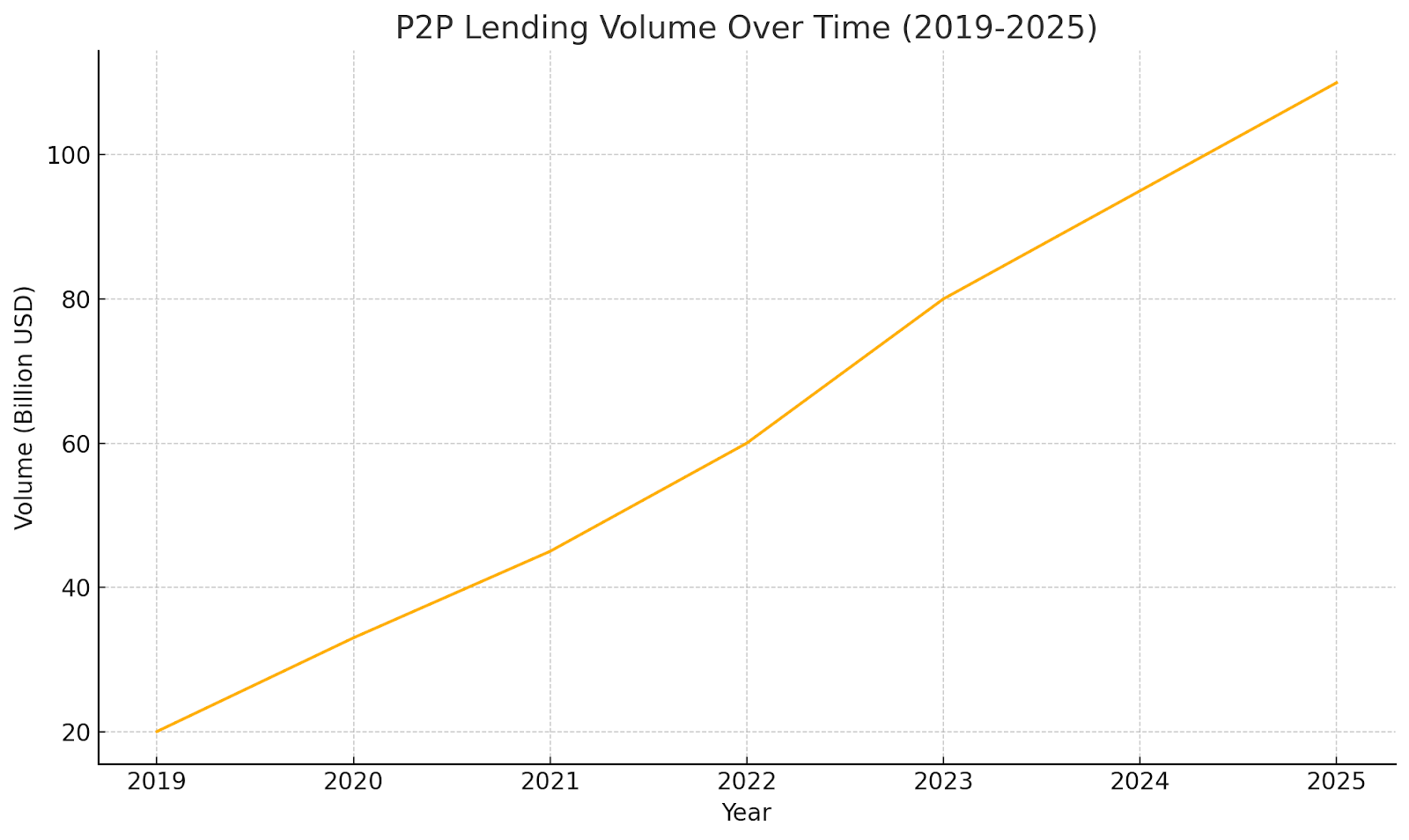

Social proof and community reviews will play a big role in lending decisions, especially in P2P lending. They give extra insights and help build trust. Platforms must follow the rules and act fairly and openly to keep lending practices honest.

Looking ahead, research should aim to improve how we use social proof and try out tools like blockchain to verify reviews. It should also tackle issues around handling growth and meeting regulatory demands. For both lenders and borrowers, knowing how these factors work together matters. It helps everyone make clear, fair choices in a changing financial world.

If you’re interested in the wondrous opportunities that P2P lending offers to finance your needs or seize the lucrative, low-risk profits in providing that credit, 8lends spreads out the risk among numerous different lenders, charging them zero commission in the process.