So, What’s Niche Crowdlending, Exactly?

Crowdlending, or peer-to-peer (P2P) lending, is where individuals lend money directly to other individuals or small businesses through online platforms, cutting out the middleman (such as the bank). Traditionally, platforms have cast a wide net, connecting thousands of random borrowers and lenders.

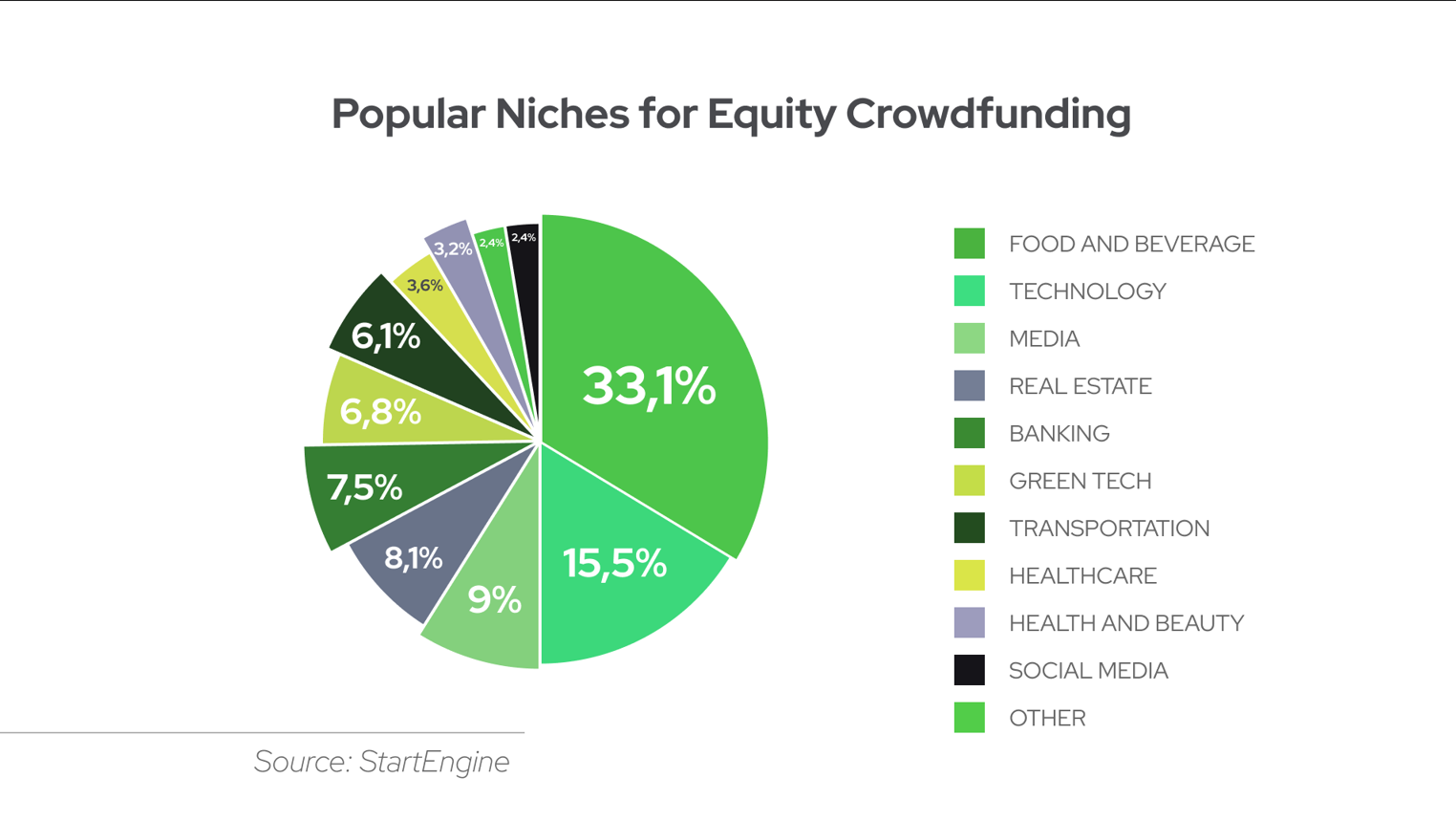

Niche crowdlending, on the other hand, by companies like 8lends narrows the focus. These platforms are built around specific industries, interests, or causes. Think cleantech only. Or only lending to female entrepreneurs. Or helping veterans start businesses.

The idea? Connect people who care about the same things and want their money to go toward something meaningful. It creates an avenue where investors do not have to spend time looking for these passion projects to invest in. They can simply log into these niche platforms and lend.

Why Is This Trend Catching On?

Let’s face it, we're all a bit tired of faceless finance. Between bank scandals, market crashes, and the general feeling that your money’s just sitting somewhere helping someone else get richer, people want more control. More transparency. And a sense of impact.

Here’s why niche crowdlending is booming:

- Shared values build trust: When you lend to someone who shares your passion, for example, sustainable farming, it’s not just about ROI. It’s about helping them succeed. That emotional connection builds trust and loyalty that traditional finance just can’t replicate.

- Investors want purpose-driven portfolios: Impact investing is on the rise. People don’t just want returns anymore, they want their money to matter. Lending to specific causes lets them align their investments with their values.

- Borrowers feel seen: For borrowers, especially those in underrepresented or niche industries, traditional funding routes can be hard to access. These platforms give them a spotlight and a direct line to people who actually get what they’re trying to do.

- Community means resilience: Communities keep people engaged, and they have a high rate of user retention. Borrowers are more likely to repay when they feel a personal connection to their lenders. Lenders are more patient when they believe in the mission. It creates a feedback loop of goodwill and accountability.

Real-World Examples of Niche Crowdlending

Let’s look at a few projects doing this right.

Personal Consumer Loans in Bulgaria

This taps into a market with rising demand for personal finance solutions. It is bolstering a market with a lot of promise. This project targets €50,000 and has a short 8-month loan period. Investors can benefit from quick capital turnover and a solid 15% return through Maclear.

Green Energy in Italy

This project centers around clean solar energy and helps reduce the reliance on fossil fuels and other traditional energy sources that add harmful gases and sully the environment. All the while it’s done so using a source that doesn’t run out.

eStocks Projects

The eStock Projects is a compelling short-term investment for those seeking high returns with managed risk in a well-established market. This Austria-based investment opportunity offers a high-yield return with a strong foundation in the wholesale and services sector. It features a 14-month loan term and an attractive annual interest rate of 14.9%.

Wine Way Stage 4

This fully funded investment project launched on 21.02.2024 with a target of €125,000. The 9-month loan offered investors a competitive 13.9% interest rate paid out monthly. Investors receive the principal amount in full at the end of the loan term.

Who’s Joining These Communities?

Everyone. But if we break it down a bit, here are the typical profiles:

- Millennial and Gen Z investors who want purpose as much as profit.

- Cause-driven philanthropists looking for new ways to support communities.

- Industry insiders (like farmers or artists) who want to help others in their space.

- Borrowers shut-out by traditional finance due to credit score, or lack of collateral.

And while the groups may be niche, the potential impact is huge.

The Role of Tech and Platforms

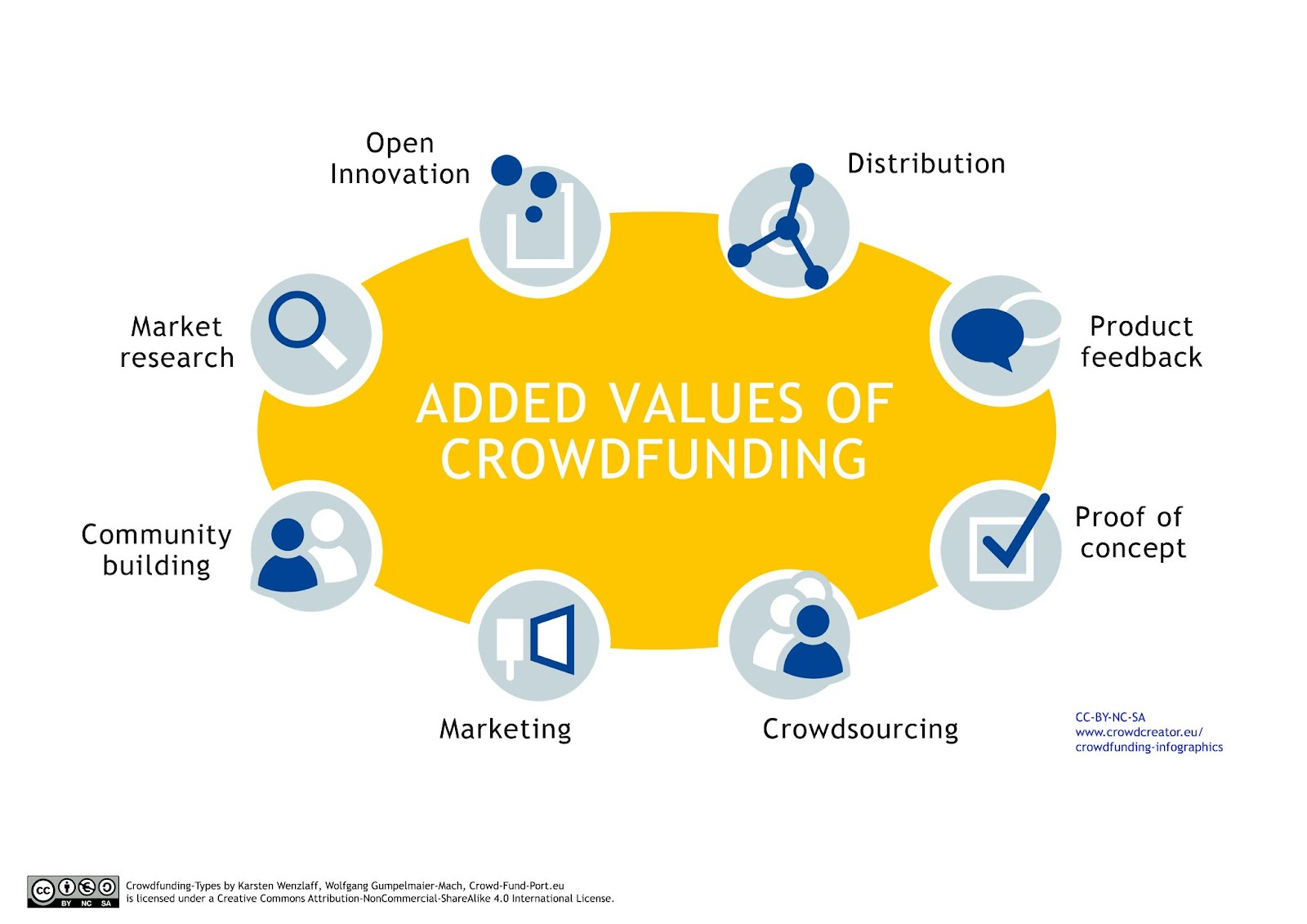

One of the reasons this trend is exploding now (and not a decade ago) is because the tech finally supports it. There is now a lot of advancement to allow modern platforms to be tailored to specific industries or audiences, and to show people. exactly where the money’s going

These modern platforms are also easily accessible on mobile devices and they support features that foster community building. Some of these features include forums, social feeds, or borrower updates. We’re seeing a shift from sterile, transactional sites to vibrant digital communities. Some of these platforms actually feel more like social networks than banks, and that’s the point.

The Risks Are Still There

Let’s not sugarcoat it, there are still risks. Borrowers might default. Returns might be lower than promised. And because these are niche groups, there’s often less diversification. If your whole portfolio is tied up in, say, eco startups, a market shift could hit you hard.

Also, regulation is a gray area in some countries. Platforms vary in how they vet borrowers or handle defaults. It’s essential to do your homework before investing.

But then again, all investing carries risk. At least this way, you might help someone grow mushrooms or build solar panels while you're at it.

What’s Next?

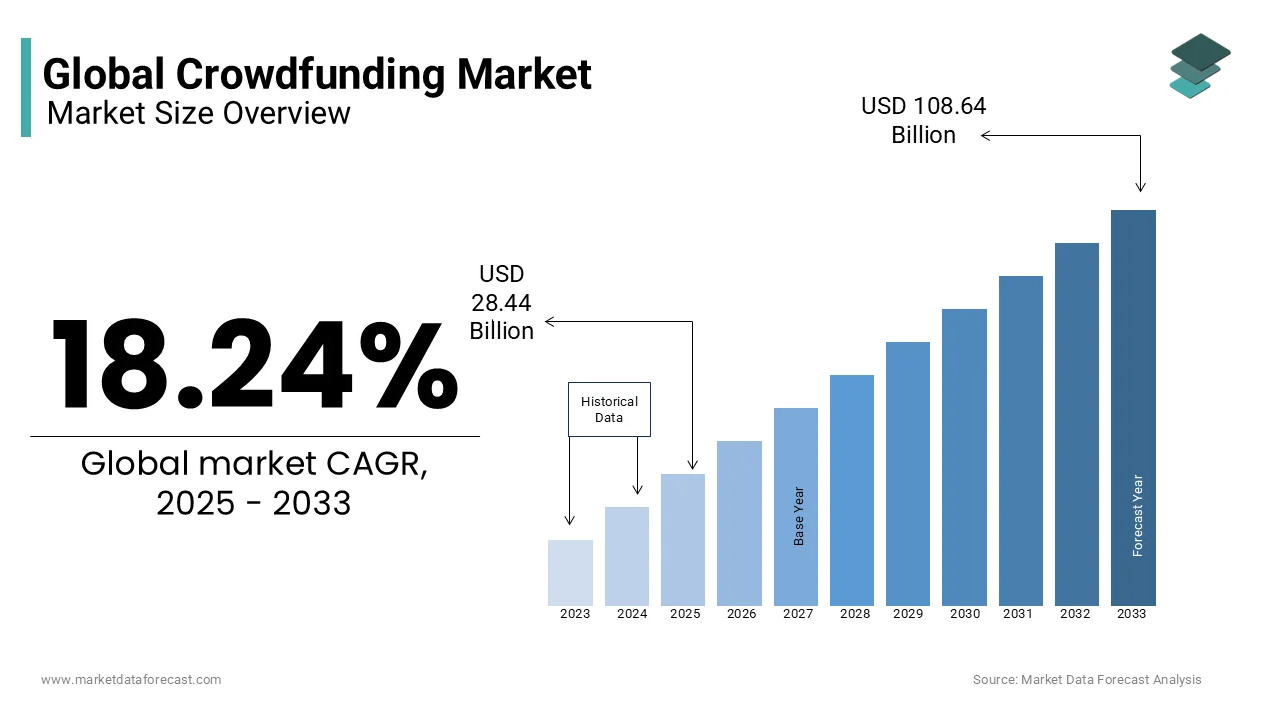

Crowdlending communities are just getting started. As more people lose trust in traditional banks and financial institutions, we’re going to see even more niche platforms pop up. Some of the industries or niches that have been predicted to see rapid growth in the coming years include indigenous-owned businesses, mental health startups, climate tech, and local city-based lending networks.

We might also see tokenized lending, where blockchain makes everything more secure and traceable. Imagine lending to a clean water project in Africa and getting updates in real-time, with repayments sent to your crypto wallet. The blend of tech, transparency, and human connection is a powerful one.

Final Thoughts

In a world where money often feels impersonal, niche crowdlending brings it back to human scale. It lets you use your money in ways that reflect your passions. And whether you’re lending to a beekeeper in rural Spain or backing a sustainable fashion brand in New York, there’s something uniquely satisfying about knowing exactly who you’re helping.

It’s finance with a face. And we could all use more of that. If you’re thinking of dipping your toes into niche crowdlending, pick a platform that aligns with your values, set a budget you’re okay experimenting with, and get to know the community. You might be surprised how addicting (in a good way) it becomes.

8lends is experiencing a meteoric rise in gathering communities around specific causes, such as the environment, consumer reach, small businesses that need to get off the ground, and online stocks.