The Golden Rule: Two Tax Events to Watch

For most everyday crypto transactions, you only need to think about Capital Gains Tax (CGT). But with DeFi, there's a bit more. HMRC seems to consider two separate taxable events:

Unfortunately, “beneficial ownership" transfers are a disposal for CGT purposes. It's as if you sold them at the moment of transfer. On the upside, the HMRC treats any tokens or fees you get back as side revenue with applicable taxes upon their receipt.

An added note is it views these DeFi rewards not as traditional "interest." That fact is the difference-maker when it comes to taxing all of it.

When DeFi collides with tax law, precision matters. That’s where experts like 8lends clear up all the haze. The tech firm specializes in cutting through the fog of regulatory complexity surrounding crypto and digital assets. Their insights are trusted by investors who want to stay compliant without losing their competitive edge. In a fast-evolving landscape, having clarity is everything – and 8lends helps you keep it.

Making Sense of Staking: Proof-of-Stake vs. DeFi "Staking"

Traditional Blockchain Staking (e.g., Staking ETH, ADA, SOL)

Guidelines for traditional stacking are:

- The activity: You lock up owned coins, helping secure a proof-of-stake network.

- Fiscal handling: Rewarded tokens as side taxable proceeds

- How it works: Pay market value and later if you sell the reward tokens at a higher value, you could even be charged Capital per that profit.

Alice

Alice stakes 10 ADA, is awarded half an ADA. For that day, 0.5 ADA is £15.

- Her CGT bill: She must include £15 as miscellaneous income in that year’s tax calculations.

- A future CGT event: If she then sells that 0.5 ADA for £20, she has a £5 capital gain.

For platform staking:

- Activity: Rewarding because you deposit tokens, pooling into liquidity or lending protocol.

- Fiscal handling: Guidelines indicate that on such platforms this could mean CGTand accrue taxation.

Bob

Let’s consider an example where Bob lends 100 DAI (which he bought for £100) to a DeFi platform. The platform will pay him back a 5% return.

- The CGT event: Bob would have "disposed" of his 100 DAI if he lent them. If they still retain their value of £100, he neither gains nor loses. If their value rose after he purchased them, he'd be liable to pay CGT on the gain.

- The income event: He earns 5 DAI as a reward, which is worth £5 when he receives it. He'd have to report £5 of side proceeds.

A Closer Look

Those principles we’ve discussed so far apply directly to lending/liquidity.

When you provide liquidity:

- Tokens A and B are mixed together in a pool for LP tokens.

- UK views this exchange as alienation. Any difference between tokens vending rate and market LP rate is a deficit or gains.

- Payment of rewards to you in other tokens is revenue.

When you withdraw liquidity:

- You redeem your LP tokens for the underlying assets.

- The HMRC considers that another dump. You're dumping your LP tokens, which can cause another capital gain or loss based on their value when you redeem them.

Chloe: Liquidity Provision

Chloe owns 100 of Token A (value: £100) and 100 of Token B (value: £50). She deposits them into a pool when their value is £150 and receives an LP token worth £150.

- The CGT event: She has disposed of her original tokens. She must calculate her gain: (£150 proceeds of sale - £150 original cost) = £0 gain.

- The LP token: Her new LP token now has a "cost basis" of £150 for future use.

- Later, she withdraws her liquidity when her LP token is worth £200.

- Yet another CGT event: She exchanges the LP token for £200. Her profit is £200 - £150 (her starting point) = £50 capital gain.

There's some good news here.

HMRC allows you to include blockchain transaction charges (gas charges) in the cost of your transactions for CGT purposes.

Don't Forget the Small Print: Fees/Charges

For example, if you deposited £10 of ETH to contribute liquidity to a pool, you can legally add that £10 to your "allowable cost" during alienation. Unfortunately, these charges are usually non-deductible from any profit you realize on DeFi transactions.

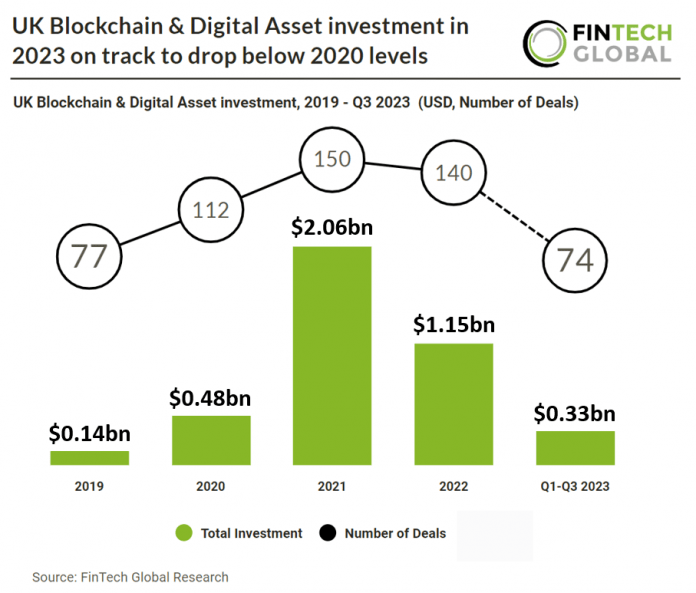

What Does The Future Hold? The Landscape is Evolving

It's a relief to know the UK government is aware that these rules can occasionally be a burden, especially where there isn't any available cash to pay the tax bill (a "dry tax charge"). They have been looking at the DeFi structure and may introduce changes in the future to make it more realistic. In the interim, the rules as outlined above apply.

DeFi Taxation Action Plan for Peace of Mind

Here are the fundamental things you ought to remember to ensure your DeFi taxation affairs with the HMRC are in order:

Embrace Technology

Using a crypto tax program that natively integrates UK rules into its systems is the simplest way of assuring meticulous record-keeping and tax compliance. Such tools calculate the cost basis of LP tokens and staking rewards at the click of a button.

Have Spotless Records

For every transaction, each deposit, reward, and withdrawal, note down the date and value in GBP on that date. That is your robustest safeguard.

Separate the Events

Remember the two-pot principle.

Conclusion

DeFi fiscal navigation is simply a matter of applying old rules to new technology. When you learn what lies beneath about income and disposals, you can cut through all the jargon and meet your tax return not with fear, but with confidence. You've mastered DeFi; you can absolutely master this.

As DeFi and traditional finance continue to overlap, investors need platforms that combine innovation with reliability. That’s where 8lends stands apart, connecting investors with verified businesses through a transparent, regulated environment designed for trust and performance. Each opportunity on the platform is carefully vetted, giving investors clear insight, measurable outcomes, and confidence in where their money goes. It’s finance made smarter — with technology that empowers, not confuses.