Italian Tax Filing 101: the Dual System

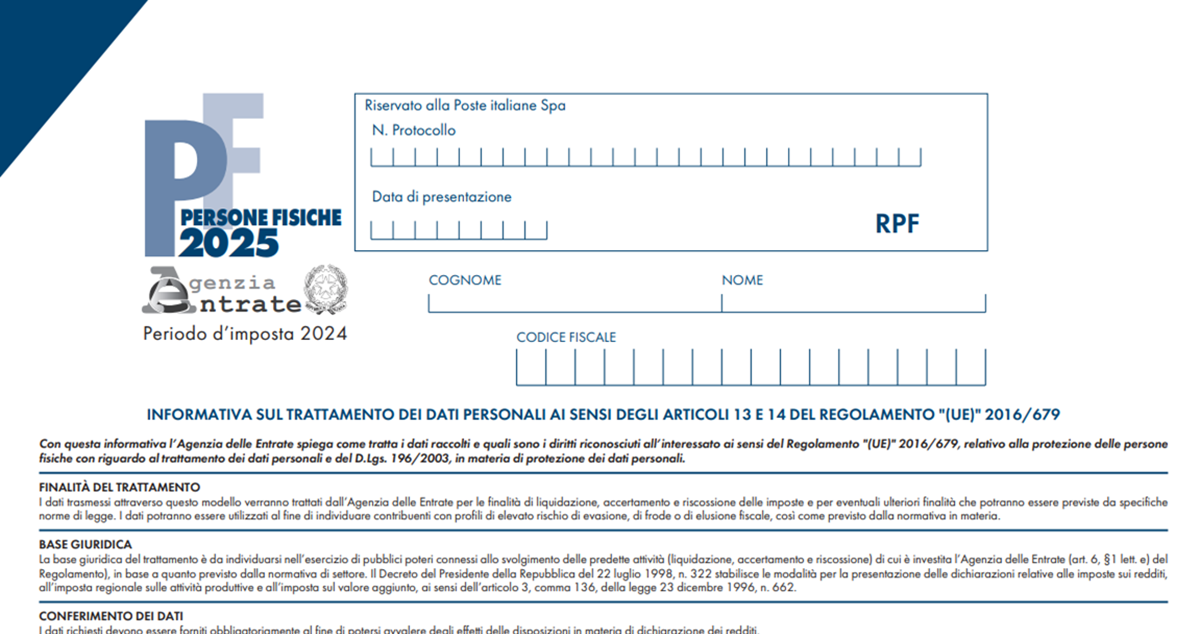

Understanding the duo of documents used in Italy for filing individual income is key to ensuring absolute compliance and avoiding penalties. These address distinct sets of payers with different complexities.

While the Modello Redditi PF requires more information and addresses more complex income government liability situations, the alternative is more straightforward, addressing simple state debt situations, such as for pensioners and employees. The major difference between these methods is the level of detail they demand.

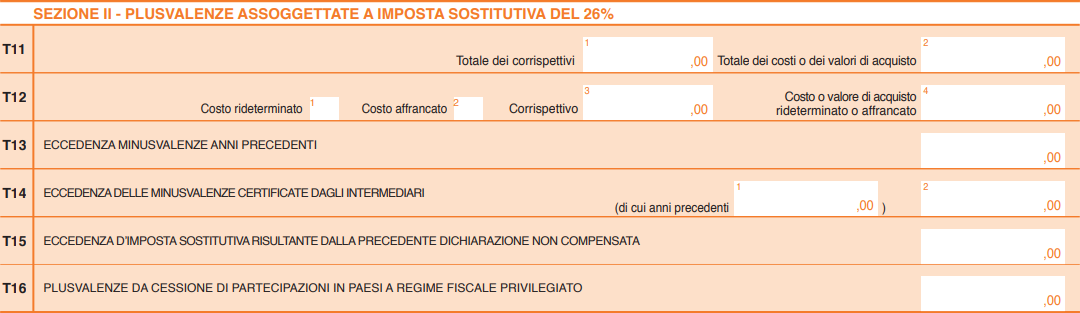

For 730, the employer usually needs to provide the income value and deductions on behalf of the payer, with the obligations often automatically generated. It also differs from its counterpart in its expedited processing, especially for refunds, where errors in calculations might have resulted in excessive deductions. Complications have largely reduced with the introduction of the Quadro T section and the digital filing by the Italian government.

In contrast, the former requires more details and complex income situations, including investment reports, self-employment profits, and business gains. It also requires more time for processing and refunds when there are overdeductions. Nonetheless, individuals with more complicated income situations can get the required flexibility they need.

Understanding the differences between Modello 730 and Redditi PF is one thing; applying them correctly to your crypto earnings is another. Many Italian investors are now turning to expert platforms on this topic, such as 8lends, which bridge traditional lending and digital asset investing, to manage their returns with better clarity and compliance.

By connecting investors with carefully screened projects and transparent reporting, 8lends helps users stay in sync with evolving Italian tax requirements, including the latest updates under Quadro T.

Modello 730: Now Includes Crypto

This previously existed as a simplified filing document that catered to only employees and pensioners. However, the improved and updated version now also caters to eligible payers who make capital gains from their trades in digital money.

Still, the eligibility criteria require the absence of an IVA (VAT number), which is indicative that you are not a business. Additionally, employees and pensioners are required to have filed their tax by the 30th of September, which is almost three months' grace beyond the returns season.

Again, this new format adds another level of ease by allowing employers to automatically calculate the liabilities and also file them on behalf of the payer. This ensures that things run smoothly, especially when there are refunds. These refunds can be processed between 4 to 6 months, and employers can simply take care of this through the payroll.

But that’s not all. The introduction Quadro T section mirrors the RT section in the Redditi alternative, ensuring that crypto investors can also file their returns with ease, provided they do not have the partita IVA.

Furthermore, a section for foreign assets declaration and calculation has also been added to the new 730 sheet, which helps holders to remit their liability from holdings in foreign exchanges.

Still, limitations such as reporting self-employment gains or profits from systematic trading, such as staking, specific international fiscal charge situations, and some advanced routes are still not covered in the new 730.

Redditi PF: The Comprehensive Alternative

In contrast to the sheet in the previous section, this method encapsulates all income situations but requires a good understanding of the complexities that come with it.

To begin with, this choice does not restrict any payer. Given its universality, business owners, self-employed professionals, and crypto traders are eligible to use Redditi PF. Also, the filing deadline is November 30th, after the year ends, giving ample time to file the charges due.

However, for crypto investors, Quadro RT and Quadro RW address the needs of investors with capital gains and those with assets in foreign exchanges. These sections are so detailed, helping to report granular activities that are beyond the scope of its counterpart.

Still, the need for professional support can sometimes be needed, especially when it comes to the complexities and technical requirements of certain sections, but this also comes at a fee. Nevertheless, the Revenue Agency’s website has great support and resources to aid individuals who want to go the self-filing route. Ultimately, substantial knowledge and attention to detail are still needed to successfully navigate your way through and avoid penalty triggers.

Crypto-Specific Considerations

Knowing the most suitable route for you will depend largely on the complexities of your virtual coins activities.

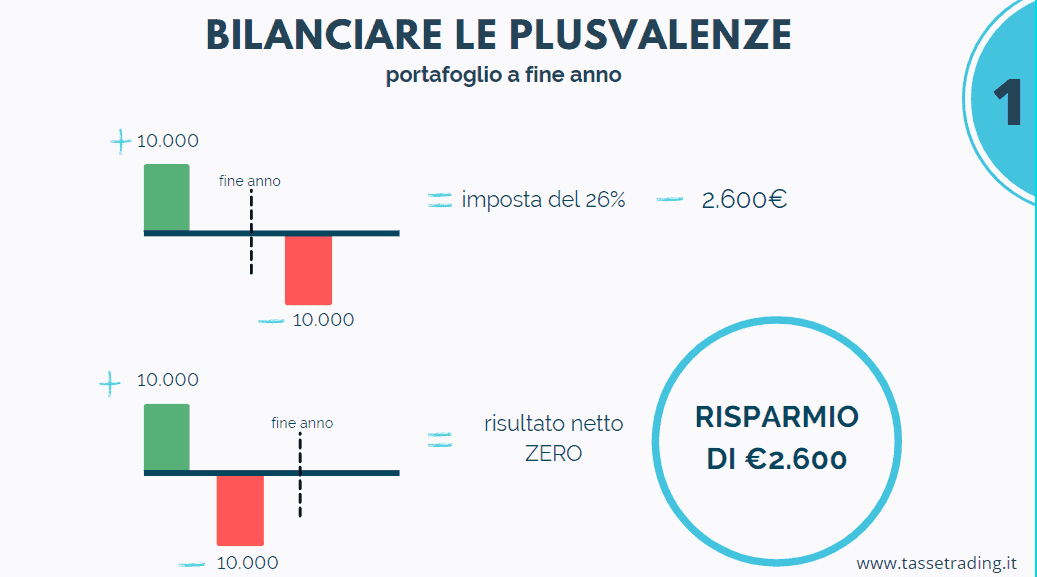

For instance, simple virtual transactions, such as earnings from sales are adequately catered for in the new Quadro T section. Even employees who engage in occasional crypto trading can directly file returns using the 730.

However, as an active investor involved in systematic virtual cash operations such as mining, staking, and other trading that generate significant income, you are classified as a business requiring the use of Redditi PF to file your liabilities. Considerations for assets held in foreign wallets and exchanges are another factor that determines the appropriate sheet to use.

While both will suffice for small holdings in foreign platforms, substantial earnings in these wallets are only adequately catered for in Redditi PF, especially when held in multiple international platforms or when involved in foreign DeFi Protocols.

Additionally, your virtual trading activities can be classified as either investment or professional, and both can significantly determine how much you pay. For investment categories, holders are liable to pay 26% capital gains, while professional traders are subject to progressive brackets that go upwards of 43%.

Decision Matrix

Critical assessment of your situation is essential when in need of a systematic approach to deciding the most suitable route for you based on you virtual currency activities, income sources, and individual circumstances.

Answer these questions:

- Do you have partita IVA?

If YES, then Redditi PF is the choice for you, considering that you are considered a business under the law and as such are subject to progressive bracket election, which is appropriately catered to in that sheet.

But if your answer is NO, then you require a 730. - Are your virtual cash activities classified as business?

If YES, then you require a Redditi PF, given that individuals who are non-business entities, including pensioners and employees, are charged for directly from source, which is filed using the 730 by the employer. - Are you an employee or pensioner?

Again, a YES means that you’ll need a 730, given that employees and pensioners are subjected to income duties, which is adequately catered for in this form. No answer means you’ll need the other one. - Do you have simple crypto capital gains?

A YES means you require a 730 for optimal reporting and filing, given that the new Quandro T section provides for simple capital gains for individuals with crypto activities. Otherwise, the alternative is what you’ll need. - Do you have complex international situations?

A Redditi PF form comprehensively caters to the needs of individuals with complex international situations under the sections RW and RT for international and foreign exchange activities.

A NO means you need a 730.

Conclusion

In a nutshell, choosing between the 730 and Redditi PF is not as easy as it seems, considering all the factors that you need to evaluate in your decision.

These factors include your income source, your international digital assets situation, and your classification under the Italian fiscal laws. Where most income earners in paid employment would opt for the 730, those with more complicated situations, such as multiple currency portfolios across several international exchanges, will get the most out of using the Redditi PF.

As Italy continues refining its tax structures for digital assets, platforms like 8lends are shaping the next evolution of compliant crypto finance. Beyond simplifying the lending and investing process, 8lends integrates transparency, automation, and verifiable on-chain data — elements that align perfectly with the new direction of Italy’s tax reporting under Quadro T.

By offering real-world asset–backed lending and automated performance tracking, 8lends ensures that both private lenders and institutional participants can operate within a clear regulatory framework without sacrificing yield or efficiency. For traders and investors navigating these new fiscal standards, such platforms are paving the way toward a more structured and sustainable digital finance ecosystem.