Why Social Media Matters in DeFi Lending

Previously, learning about loans in traditional finance generally entailed reading fine print, navigating old websites, or consulting a banker. However, DeFi has now changed what used to be the norm and social media is driving the change.

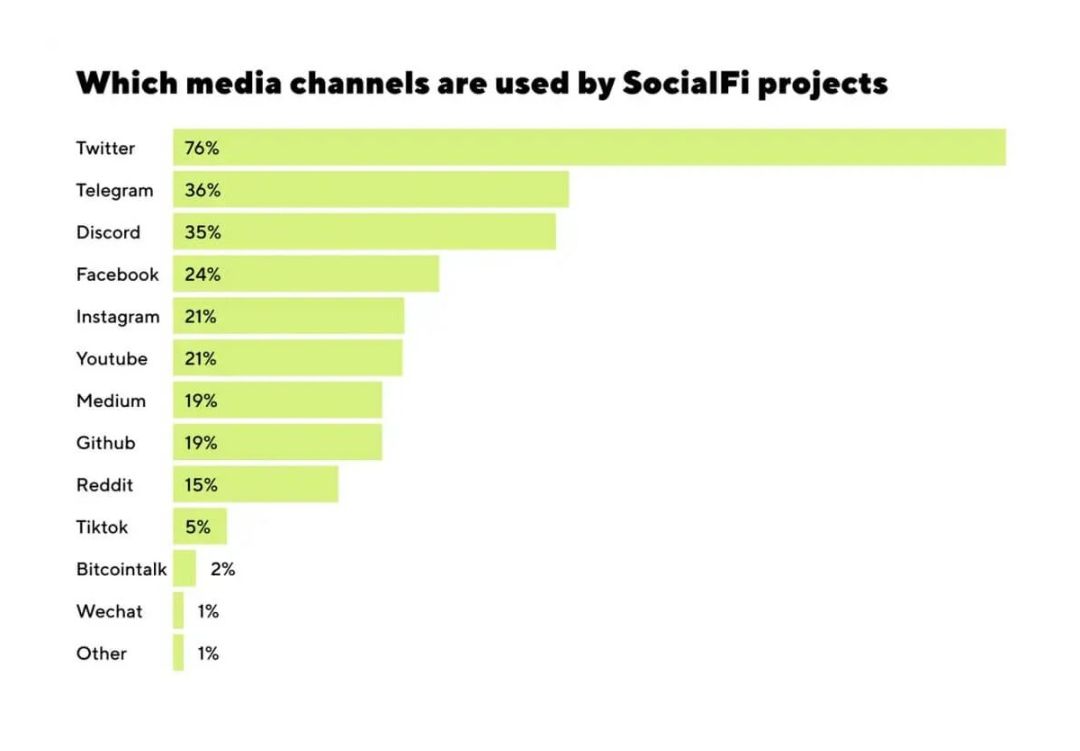

Discovery of new DeFi lending techniques now mostly happens on sites like X (previously Twitter), Reddit, and Telegram. Here there are no gatekeepers. Real people sharing their experiences, wins, and cautions in real time are taking the former place of official pamphlets and sales agents. Social media is such a potent instrument for DeFi adoption because of that kind of honest communication.

Transparency comes among the main benefits. DeFi projects post regular updates, bug repairs, security audits, and governance suggestions on these systems. Users can follow along, probe questions, and even help to shape the direction of a platform. It's about joining in on the process, not merely reading.

Education also depends highly on social media. Not everyone has the time (or patience) to peruse technical papers. Bite-sized materials such Twitter threads, YouTube explainers, and beginner-friendly infographics are therefore quite useful. They simplify difficult concepts, like how lending pools operate or how interest rates are set, into something anyone can grasp.

Not to mention the influence factor either. In the crypto field, trusted speakers sometimes bring their followers fresh tools and platforms. These leaders inspire confidence and pique curiosity whether they be a quick TikHub from a crypto instructor or a deep dive thread from a DeFi researcher. Shortly put, social media brings DeFi lending to life rather than only discussing it.

Community Engagement: The Engine Behind Trust

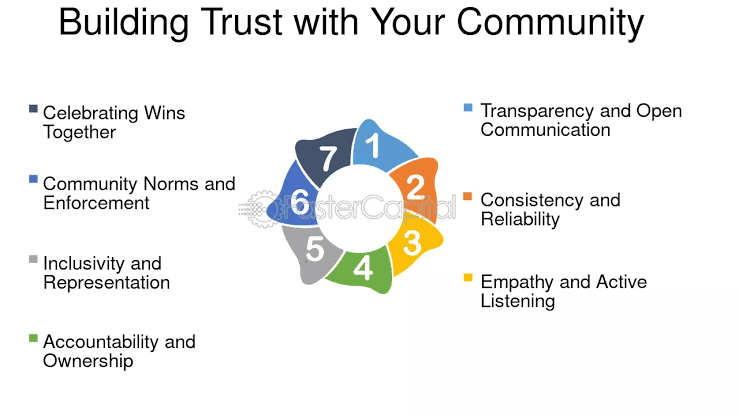

DeFi is still the newcomer on the financial block. And when it comes to your money, trust is not natural. It needs to be earned. Community involvement thus fills in and undertakes the heavy burden.

Users of an engaged DeFi community create confidence rather than merely obtaining data. Real people are sharing freely about their experiences, the good and the bad. While one might offer a bitter lesson from a platform that failed, someone else might talk about how they obtained consistent returns lending on a protocol. These open dialogues enable newcomers to avoid mistakes and experience less isolation in the process.

Many sites tilt toward this by hosting AMAs (Ask Me Anything events) whereby developers and founders live to answer community questions. Not scripts or filters; just direct responses. Such a kind of openness is rather important. Next comes the government. From new features to pricing structures, some DeFi systems allow users to vote on major decisions live in Discord threads or dedicated forums. People who feel heard are more inclined to stay around, help the initiative, and tell others about it.

Other methods sites use to remain in touch with consumers are community calls, Telegram chats, and even live YouTube videos. These channels provide everyone an opportunity to interact personally with the staff, updates, and explanations of changes.

Peer evaluations are particularly helpful. Often more weight comes from a tweet from a fellow user who has been lending on a platform than from a showy advertisement. Individuals trust individuals, not logos.

How Social Media Drives DeFi Lending Adoption

What you do not know exists cannot be used, thus social media and community involvement are starting to show results. Every tweet, Reddit post, or Discord exchange puts DeFi lending on someone's radar. This is actual people discussing real tools they actually use, not a banner advertisement or a cold pitch.

But awareness is only one aspect. Attaining success requires building confidence as well as safety when someone observes others giving, earning, and even troubleshooting problems together. From the outside, DeFi can appear dangerous. Inside an engaged community; however, users experience educated support. That helps one to much more easily take the leap.

It is also significantly influenced by education. Chances are you will find a simple-to-digest response in a thread or a five-minute YouTube tutorial if you have ever asked how interest is earned in a lending pool or what happens when a borrower defaults. Communities translate difficult concepts into understandable forms. So the outcome is More people are eager to engage since they finally understand it.

Involvement also promotes user retention. People who feel connected to a community and believe their voice counts are more inclined to stay around. They offer comments, votes on means of enhancements, and even assist with onboarding new customers. Such a type of loyalty has to be developed. It cannot be purchased.

Not to overlook viral expansion either – combining a great product with an active community will generate buzz that travels quickly. One person reports their lending returns on social media while another responds with their experience, and soon a complete thread is generating questions. Before you know it, a specialty loan system begins to grow really popular.

DeFi lending is not a vacuum, in short. It grows among people, sharing, learning, and group building. In the realm of distributed money, social media and community hold actual power.

The dual benefit of rapid communication on social networks is that on top of the word spreading quickly peer-to-peer lending platforms have also lowered the bar for companies and persons in need of loans. Revolutionary crowdlending platforms like 8lends allow for ordinary Joes to obtain loans online while investors enjoy the guarantee of collateral and spreading out their risk among multiple projects.

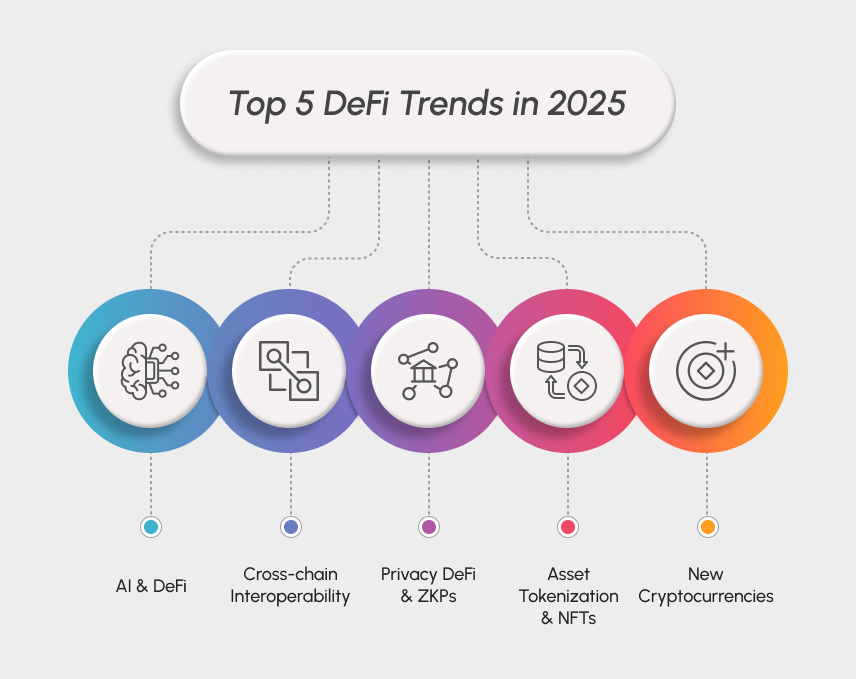

What’s New in 2025: Social and Tech Trends Shaping the Space

DeFi is changing quickly. In 2025, it will go beyond simply improved lending rates or shiny interfaces. It's about how people are interacting, learning, and discovering on various channels. Social and technological trends are changing the landscape. If you pay attention, you can easily tell what directions things are headed in.

First, let us discuss micro-creators. These are not your usual crypto influencers with mass followings. On sites like TikHub, YouTube Shorts, and even Instagram Reels, there are specialized DeFi teachers cultivating devoted communities. They are gaining popularity as they let DeFi feel relevant even if ideas like collateral ratios or staking payouts seem complex.

Content driven by DAO comes next. Some DeFi communities compensate authors straight up utilizing treasury money rather than depending on marketing teams. Tutorials, explainers, even memes are so funded by the community, for the community. This type of grassroots promotion is fresh and maintains authenticity.

Social platforms are also changing. Direct interfaces between DeFi systems and apps like Discord and Telegram have become more common in 2025. Without ever leaving the chat, wallets link with a click, and users can lend, vote, or control portfolios.

As for encouragement? AI is starting to take over. These days, intelligent bots and moderators cover everything from identifying frauds to interest rate explanations. It’s faster, smarter, more responsive than it has ever been.

Examples of DeFi Platforms Leveraging Social & Community Power

Some DeFi systems live on social and community rather than merely using them. These initiatives show that community-driven development is not only a great bonus but rather a fundamental component of the approach.

Consider Aave. Apart from being among the most reliable lending sites, Aave has established a name for excellent governance. Plans, arguments, and real-time updates abound in its forums and Discord channels. Token holders actively influence the protocol's development from interest rate models to new collateral kinds. Open cooperation of this nature keeps users involved and motivated.

Another DeFi essential is Compound. Compound is renowned for its clarity. Out in the open and prioritizing community involvement are protocol improvements, policy changes, and risk analyses. Users of the platform help direct its course, rather than just observing.

DeFi meets the professional world rather nicely with Maple Finance. Although Maple employs social media – think blog breakdowns, AMA sessions, and Twitter threads – to create trust with a more conventional audience, while it is mainly focused on institutional lending. Their method emphasizes the need for transparent communication even in cases involving major capital.

Many platforms are also getting crafty with their features. For helping each other, voting on each other’s ideas, or delivering instructional materials, some provide users’ NFTs or badges. Others concentrate on mobile-first experiences, integrating portfolio tools and community conversations straight into the app, thereby enabling simple on-demand connectivity.

These illustrations demonstrate that creating a movement is more important than only having a product. DeFi platforms create ecosystems people genuinely want to participate in when they leverage community power.

Conclusion

Social media and community involvement are not mere background noise in DeFi; rather, they drive its expansion. From trust and real-time help to education and openness, they have made DeFi lending more approachable than it has ever been. So, if you're interested in this area, don't just lounge about on the sidelines. Explore the forums, join a Telegram group, and track some DeFi producers. Along the road, you'll learn faster, feel more confident, and maybe even spot your next job.

If the thought of engaging in crowdlending or obtaining P2P credit has captured your fancy, 8lends conducts some of the most inspiring project funding, getting worthwhile businesses off the ground and helping to make the Earth more livable.