BuyBack — 100% Principal Guarantee

Invest in real businesses worldwide. Clear terms, real collateral, monthly interest payments, and returns up to 25% APR

8lends is a crypto crowdlending platform where investors fund real small and medium businesses.

You choose a project → invest in USDC → receive monthly interest → claim your principal at the end of the term.

All investments carry risk: payment delays, business difficulties, or market changes. We reduce these risks through due diligence, real collateral, BuyBack protection, and full blockchain transparency.

The BuyB badge means 100% principal protection.

If a borrower delays payment for more than 60 days:

- Our BuyBack partner repurchases your loan

- You receive 100% of your principal

- All interest earned before the delay stays with you

This is the highest level of protection on the platform.

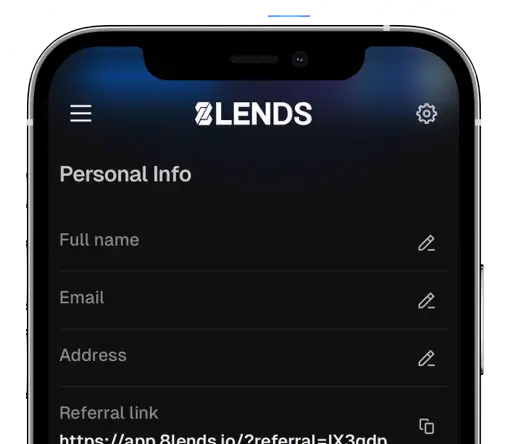

All actions happen directly through your crypto wallet. You top up your wallet with USDC → invest → funds go into a smart contract → interest and principal are returned straight to your wallet.

Every borrower goes through multi-layer due diligence by Maclear AG based on 40+ internal criteria:

financial stability, credit history, collateral liquidity, risk scoring, business model, documentation quality, and more.

USDC is a fully regulated stablecoin compliant with MiCA and recognized as safe across the EU.

It provides stability, fast transfers without banking delays, and works perfectly for our mainly European investor base.

Project yields on 8lends range from 18% to 25% APR, depending on project duration and risk profile.

At the end of the loan term, you claim your principal + the final interest payout in a single transaction.

Example: you invest in January → 6-month term → in June you claim both interest and principal at once.

The minimum investment amount is 100 USDC.

Yes, users from most countries can invest.

Exceptions include the USA, Russia, and several restricted jurisdictions.

The only fee you pay is the gas fee for blockchain transactions. 8lends runs on Base network — you will need a small amount of ETH (Base) to perform transactions.

For the first 30–60 days, Maclear AG works with the company to resolve the issue.If the project has a BuyB badge:

- You get 100% of your principal back

- All interest earned before the delay stays with you

If there is no BuyB:

- Maclear AG begins collateral recovery

- Sale proceeds are distributed proportionally among investors

No, investments are locked until the end of the loan term.

However, our roadmap includes a secondary market, which will allow early exits. The feature is not available yet.

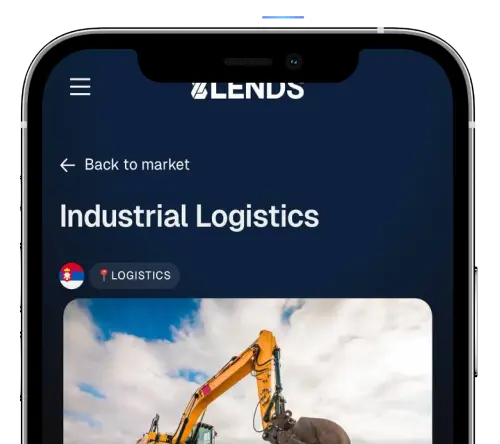

Small and medium businesses in developing regions often cannot access fast, reliable, or affordable financing:

- banks are slow or unstable

- interest rates are much higher than in the EU

- local currencies are volatile

- strict bank requirements block many companies

- traditional financing includes high fees and costly intermediaries

Through 8lends, businesses reduce costs and get funding quickly — allowing them to offer higher yields to investors.

At the same time, loans are backed by real business assets and controlled by Maclear AG.

Yes. After full due diligence, each borrower receives a rating from AAA to D, reflecting their financial stability, risk profile, and collateral quality.